Do Refund Anticipation Products Help or Harm American Taxpayers?

Do Refund Anticipation Products Help or Harm American Taxpayers?

Many taxpayers rely on for-profit tax preparation services to file their income taxes. To make tax filing more appealing to taxpayers, preparers offer financial products that speed up the delivery of refunds. However, recent U.S. Census Bureau research suggests that these products may make families less financially secure.

“A Loan by any Other Name: How State Policies Changed Advanced Tax Refund Payments” examines the impact on taxpayers of state-level regulation of refund anticipation loans (RALs). Both refund anticipation loans and refund anticipation checks (RACs) are products offered by tax preparers that provide taxpayers with an earlier refund (in the case of a refund anticipation loan) or a temporary bank account from which tax preparation fees can be deducted (in the case of a refund anticipation check). Each product comes at the cost of high interest rates (often an annual rate of more than 100 percent) and fees and is very costly when compared to the value of the refund.

States have responded to the predatory nature of refund anticipation loans through regulation. The working paper specifically looks at how the implementation of New Jersey’s interest rate cap in 2008 (no more than 60 percent annual rate) of RALs affected taxpayers. Evidence suggests that the use of refund anticipation products among taxpayers living in ZIP codes near New Jersey’s border with another state increased after the policy changed. In other words, New Jersey’s regulation appears to have suppressed the volume of refund anticipation products offered within the state, with taxpayers near the border crossing into a bordering state to use the products.

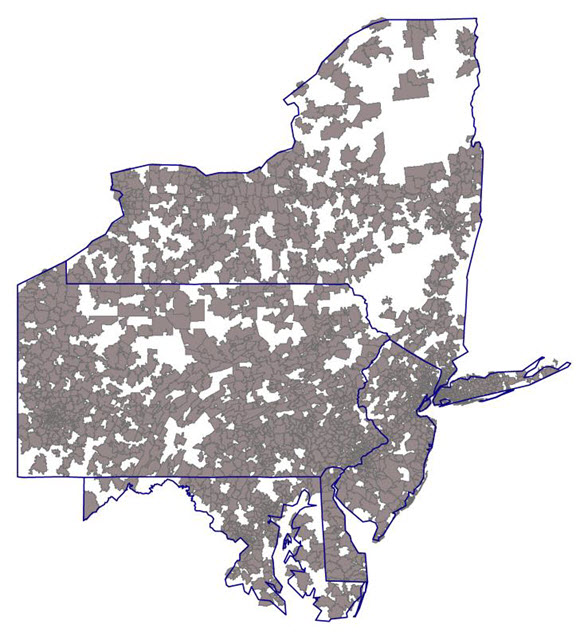

Meanwhile, border taxpayers’ use of key social programs such as the Supplemental Nutrition Assistance Program, Temporary Assistance to Needy Families and Supplemental Social Security also increased. In other words, after the change in policy, use of both refund anticipation products and social programs increased for taxpayers in New Jersey border ZIP codes compared with other families, indicating greater hardship. The map below shows the ZIP codes used in the analysis.

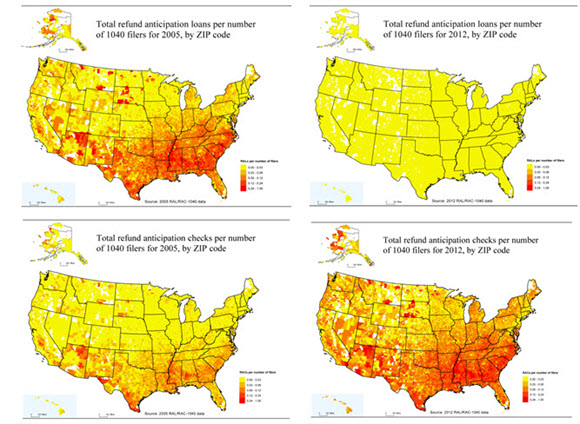

At one time, the Internal Revenue Service informed preparers if there was an offset on a taxpayer’s refund. Under pressure from consumer advocates, the IRS stopped providing the indicator in 2010. By 2012, all of the major tax preparation companies in the industry had withdrawn from the RAL market, turning to RACs as a replacement. Consumers paid a minimum of $648 million in RAC fees in 2014. The maps show the withdrawal from the RAL market and the increase in the RAC market between 2005 and 2012.

Refund anticipation products pose important questions for policymakers. In order for people filing taxes to receive higher refunds, tax preparers file additional forms that include claims for credits and deductions, which therefore increase tax preparation costs. This translates to higher charges for low-income taxpayers who are eligible for these credits and deductions. Moreover, preparers target RALs and RACs to low-income taxpayers who expect substantial refunds through redistributive credits such as the Earned Income Tax Credit, arguing that RALs and RACs speed up refund receipt and help taxpayers pay off more pressing debt or bills quicker, making low-income families better off. However, some portion of this refund money goes directly from the tax and transfer system to tax preparers rather than intended recipients.