Poverty Measure That Includes Noncash Government Assistance Increased to 12.9% in 2023, Up From 12.4% in 2022

The Supplemental Poverty Measure (SPM), which includes noncash government assistance, increased for the second consecutive year to 12.9% in 2023 from 12.4% in 2022, according to U.S. Census Bureau survey data released today.

The addition of noncash benefits like SNAP lifted another 6.6 million people out of poverty (not statistically different than the number lifted out of poverty in 2022), leaving 43.3 million people in poverty in 2023 once all benefits (not including taxes) were considered.

The 2023 SPM rate remained above the pre-pandemic rate of 11.8% in 2019.

Every year, the Census Bureau releases the official poverty measure and the SPM.

The official poverty measure defines poverty by comparing pretax money income to a poverty threshold adjusted by family size, number of children and householder age.

The SPM expands this definition by including income and payroll taxes, tax credits and other noncash benefits like the Supplemental Nutritional Assistance Program (SNAP) and housing subsidies. Necessary expenses such as child support paid, work and child care and medical expenses are deducted from SPM resources.

The SPM can be split into four components:

- Market income minus nontax expenses (wages, earnings, retirement and investment income, and earnings from other nongovernmental sources less medical and work expenses and child support paid).

- Social insurance (Social Security, Supplemental Security Income, unemployment insurance, workers' compensation, other public assistance).

- Noncash benefits (SNAP, Special Supplemental Nutrition for Women, Infants, and Children (WIC), National School Lunch Program, utility and housing assistance).

- Taxes and credits (state and federal income taxes, payroll taxes, stimulus payments, and tax credits).

How Government Assistance and Taxes Impact Poverty Rates

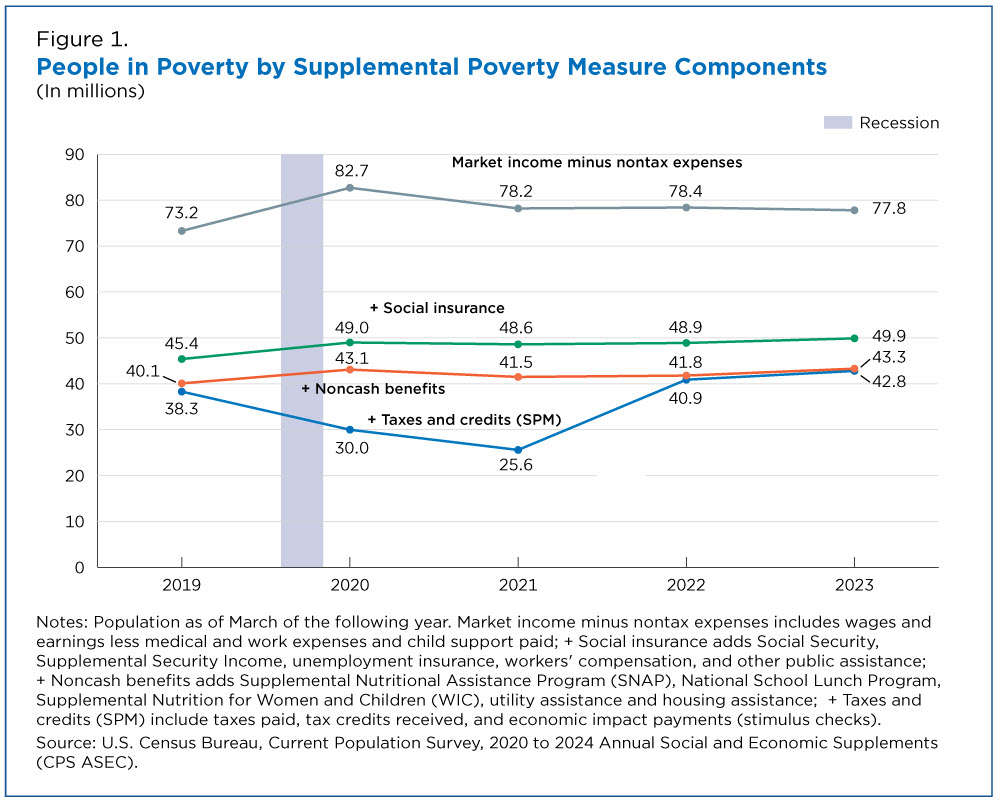

Figure 1 highlights the importance of each SPM component between 2019 and 2023.

This period covers the year (2019) before the COVID-19 pandemic; three years (2020-2022) during the pandemic; and the year (2023) in which the World Health Organization recognized the pandemic ended.

During these years, the safety net of social insurance, noncash benefits and tax credits varied in generosity, which impacted the number of people in poverty when measured using the SPM.

The grey line at the top of the figure shows the number of people in poverty when only accounting for pretax/transfer market income minus medical and work expenses and child support paid.

Each following line incorporates additional income components. For example, “Social insurance” includes both pretax/transfer market income and social insurance income, while “Noncash benefits” includes both components as well as noncash benefits.

For this analysis, poverty thresholds (determined by resource unit composition) are unchanged across measures. Only resource components change across lines.

In 2023, 77.8 million people in the United States were in poverty using a measure of resources that included only market income net of necessary nontax expenses.

This number declined by 28.0 million to 49.9 million people in poverty when social insurance programs were added to resources. This decline was less than in 2022, when social insurance programs removed 29.5 million people from poverty.

The addition of noncash benefits like SNAP lifted another 6.6 million people out of poverty (not statistically different than the number lifted out of poverty in 2022), leaving 43.3 million people in poverty in 2023 once all benefits (not including taxes) were considered.

After accounting for taxes paid and tax credits received, 42.8 million people were in SPM poverty — not statistically different than the number (43.3 million) in poverty before including taxes and credits.

Changes in Tax Policy Affected Families Differently

Families with children may qualify for larger tax benefits through the U.S. tax code compared to families without children.

Between 2019 and 2023, there were several tax policy changes, such as economic impact payments (stimulus checks) and a temporarily expanded Child Tax Credit, which had major impacts on peoples’ poverty status.

Today’s report shows that refundable tax credits, such as the Earned Income Tax Credit (EITC) and the refundable portion of the Child Tax Credit, lifted 3.4 million children above the poverty line in 2023.

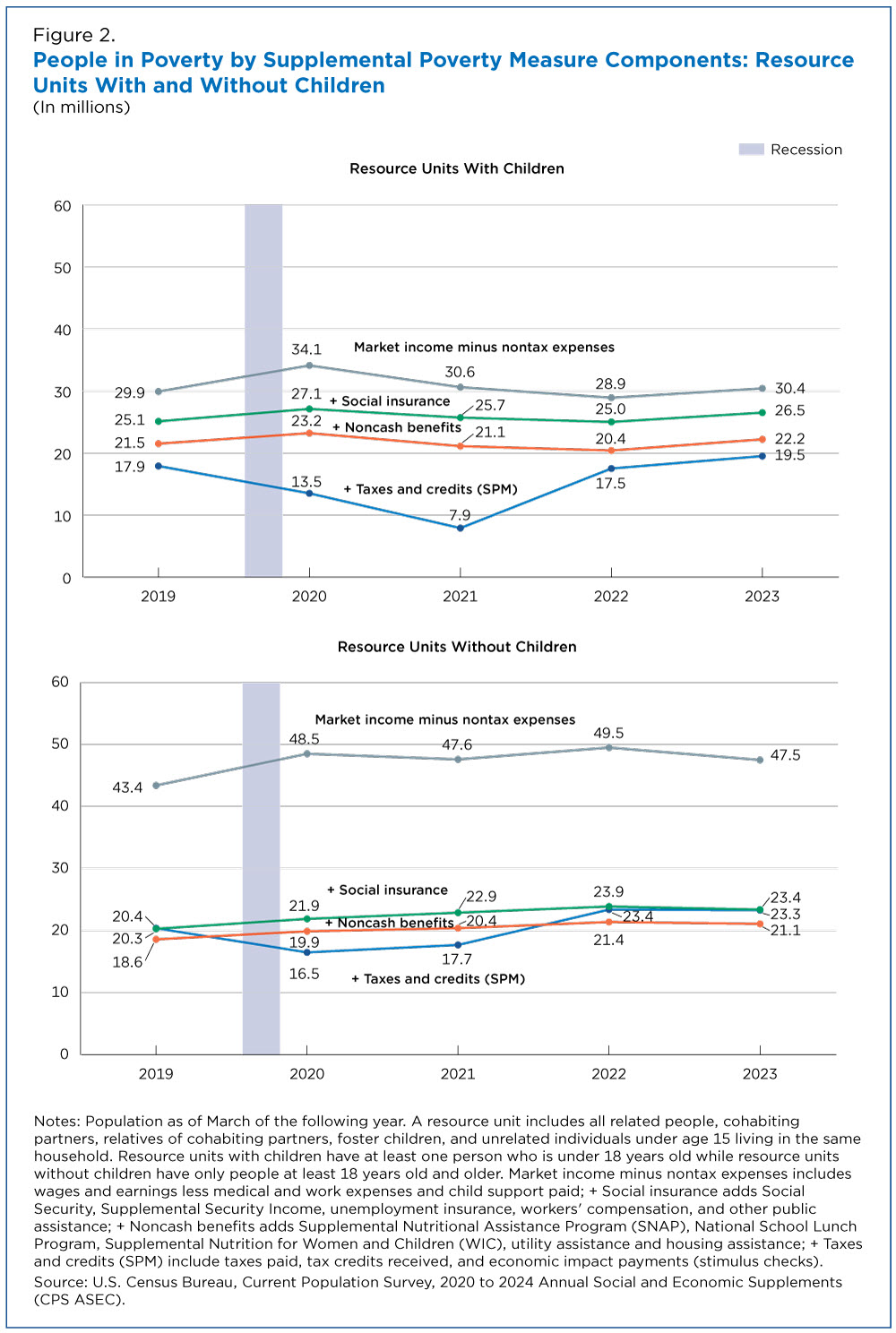

Figure 2 shows people in poverty by presence of children (a person under 18 years old) in the resource unit.

Resource units include all related persons, cohabiting partners, relatives of cohabitating partners, foster children and unrelated individuals under age 15 living in the same household.

The inclusion of social insurance in SPM resources resulted in decreases in the number of people in poverty for both resource unit types. However, there are noticeable differences in the impact of taxes by presence of children.

Between 2019 and 2021, the number of people in SPM poverty declined significantly (down 10.0 million) among those living with children (top panel of Figure 2). The declines for this group were largely due to the three rounds of pandemic stimulus checks and the temporarily expanded Child Tax Credit in 2021. As pandemic-era tax policies expired, the number of people in poverty increased among those living with children.

The bottom panel of Figure 2 shows the number of people in poverty for units without children.

Over the 2019-2023 period, social insurance reduced the number of people in poverty living without children between 50.8% and 54.9% (decreases in 2021 and 2022 were not statistically different). SPM units without children were more likely to be comprised of adults over age 65, who are the primary beneficiaries of Social Security.

For resource units without children, the inclusion of taxes and credits increased the number of people in poverty in 2022 and 2023 (these increases are not statistically different). Approximately 2.2 million more people fell below their poverty threshold in 2023 after accounting for taxes in SPM resources.

Both decreased from 2019 to 2020, yet the poverty rate for resource units without children leveled off (in fact, it increased slightly) between 2020 and 2021 while the rate for resource units with children continued to fall from 2020 to 2021.

It appears that increases in social safety net generosity in 2021 (via stimulus payments) were not large enough to prevent increases in the number of people in resource units without children below the poverty line.

A working paper with more details about the impact of tax and transfers by family composition is set to be released this fall. The annual poverty report, Poverty in the United States: 2023, provides more details on the impacts of policies and programs on the SPM rate.

The technical documentation page includes information on confidentiality protection, methodology, sampling and nonsampling error, and definitions. All comparative statements have undergone statistical testing and are statistically significant at the 90% confidence level unless otherwise noted.

Related Statistics

Subscribe

Our email newsletter is sent out on the day we publish a story. Get an alert directly in your inbox to read, share and blog about our newest stories.

Contact our Public Information Office for media inquiries or interviews.

-

Income and PovertySupplemental Poverty Measure Below Official Poverty Rate in 32 StatesSeptember 10, 2024Unlike the official poverty rate, the Supplemental Poverty Measure accounts for government assistance to low-income families.

-

Income and PovertyMedian Household Income Increased in 2023 for First Time Since 2019September 10, 2024Non-Hispanic White households were the only group with higher incomes in 2023. Asian household median income remained the highest among all groups.

-

HealthHow Age and Poverty Level Impact Health Insurance CoverageSeptember 10, 2024The percentage of people without health insurance remained around 8% in 2023 but rates varied by age and poverty level, according to data released today.

-

HousingShare of Owner-Occupied, Mortgage-Free Homes Up in 2024January 29, 2026The share of U.S. homeowners without a mortgage was higher in 2024 than a decade earlier nationwide and in every state, though not all counties saw increases.

-

HousingRental Costs Up, Mortgages Stayed FlatJanuary 29, 2026Newly Released American Community Survey compares 2020-2024 and 2015-2019 housing costs by county.

-

IncomeHow Income Varies by Race and GeographyJanuary 29, 2026Median income of non-Hispanic White households declined in five states over the past 15 years: Alaska, Connecticut, Louisiana, Nevada, and New Mexico.

-

PopulationU.S. Population Growth Slowest Since COVID-19 PandemicJanuary 27, 2026The decline in international migration was felt across the states, though its impact varied.