Households With a White, Non-Hispanic Householder Were Ten Times Wealthier Than Those With a Black Householder in 2021

Households with a White, non-Hispanic householder had 10 times more wealth than those with a Black householder in 2021, according to the U.S. Census Bureau’s Survey of Income and Program Participation (SIPP).

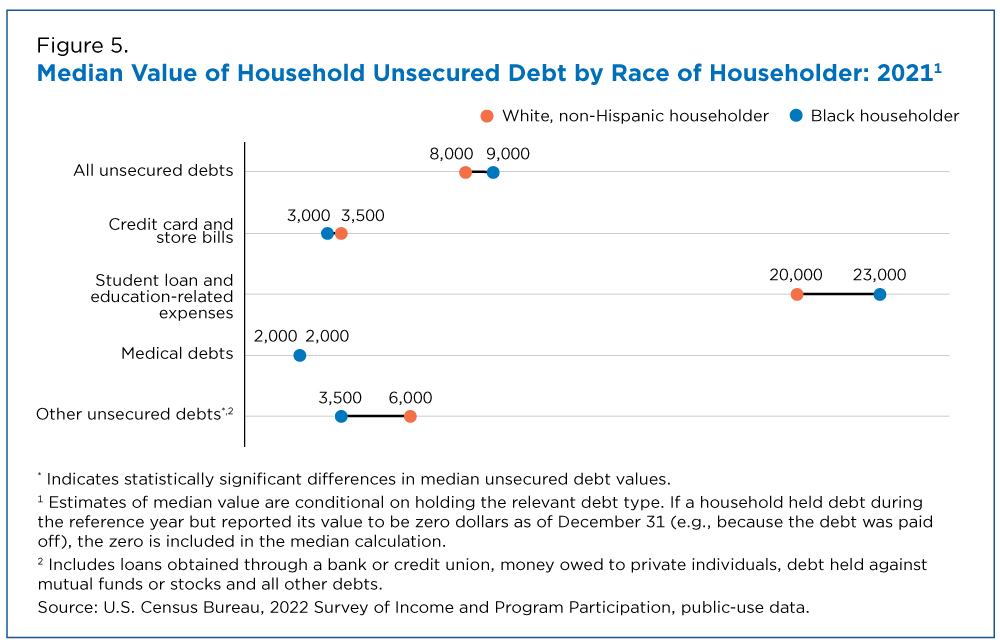

Households with a Black householder were more likely than those with a White householder to have unsecured debt (61.3% vs. 53.4%), especially student loan (25.8% vs. 17.2%) and medical debt (22.5% vs. 13.4%).

A householder is a person who owns or rents a housing unit and whose name appears on the deed or lease. In this article, White is used to describe non-Hispanic White householders; Black householders can be either Hispanic or non-Hispanic.

In 2021, households with a White householder made up 65.3% of all U.S. households and held 80.0% of all wealth.

Those with a Black householder made up 13.6% of all U.S. households but held only 4.7% of all wealth. And their median wealth ($24,520) was about one-tenth the median wealth of households with a White householder ($250,400).

Wealth is the value of assets owned minus the value of debts owed. It provides economic security, serving as a source of liquidity during times of unstable income or in the face of unexpected expenses, and opportunities for upward mobility [PDF <1.0 MB].

The latest SIPP tables on household wealth in 2021 show wide variations across demographic and socio-economic groups.

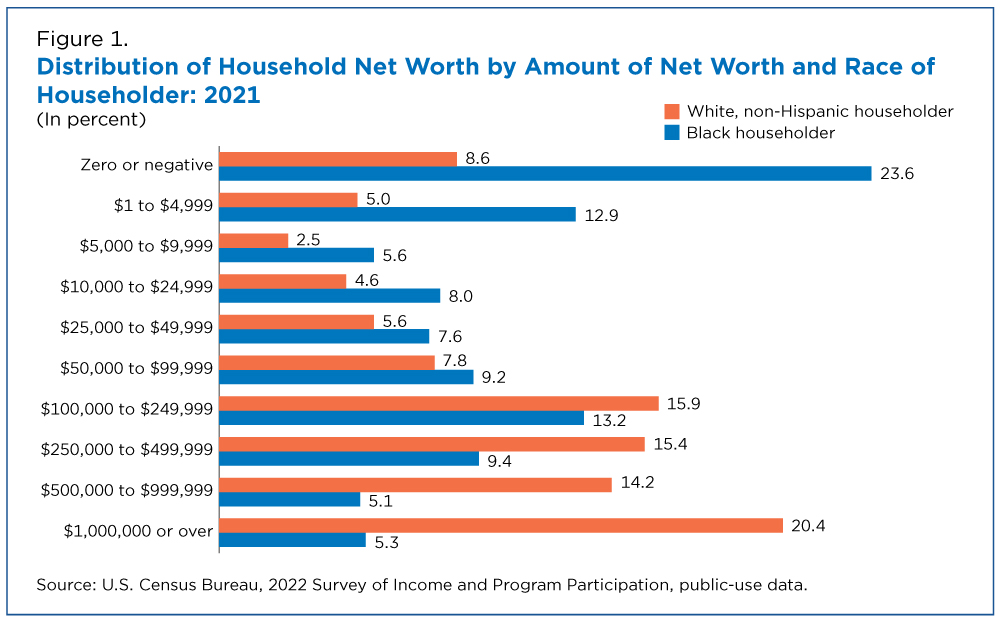

How Household Wealth Is Distributed by Race of Householder

About 1 in 5 households with a White householder and 1 in 20 households with a Black householder had wealth over $1 million (Figure 1).

Just under 1 in 4 households with a Black householder and 1 in 12 households with a White householder had zero or negative wealth.

Households with negative wealth do not have a direct safety net to draw upon in times of need; they are more likely than other households to experience higher rates of financial insecurity and are vulnerable to economic shocks.

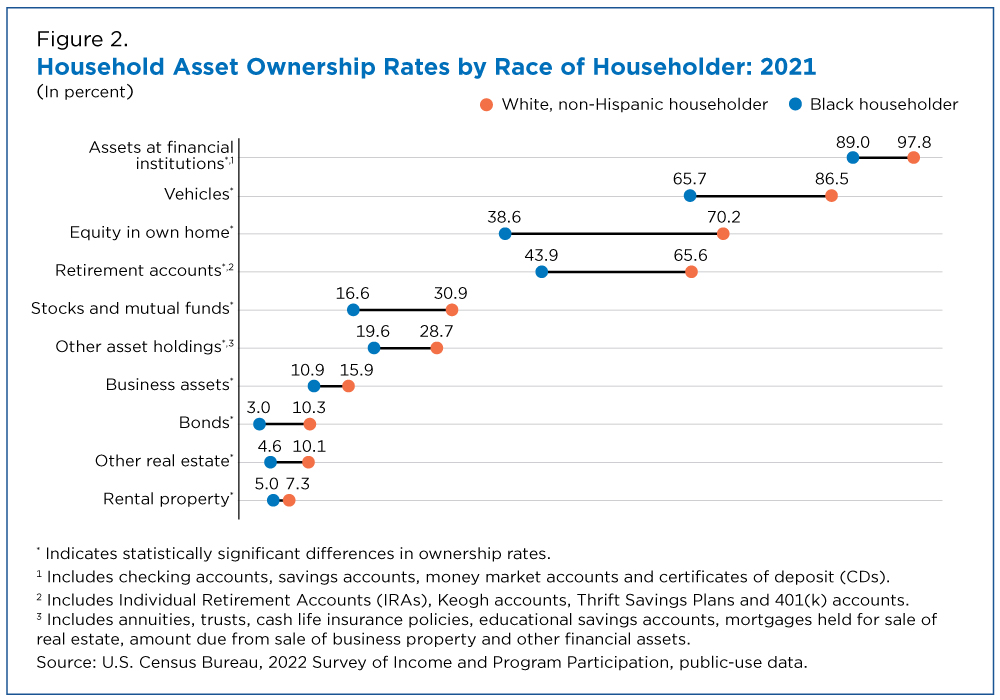

How Asset Ownership Differs by Race of Householder

Types of assets held and the value of those holdings determine a household’s total wealth.

Wealthier households are more likely to hold income-generating assets like stocks and mutual funds or real estate outside of a primary home. Those with less wealth typically hold a larger share of their wealth in less risky liquid assets, like bank accounts.

Differences in the composition of wealth can have implications for building wealth and passing it along to future generations, contributing to the persistence of the racial wealth gap.

Households with a White householder were more likely than households with a Black householder to own all asset types measured by the SIPP (Figure 2).

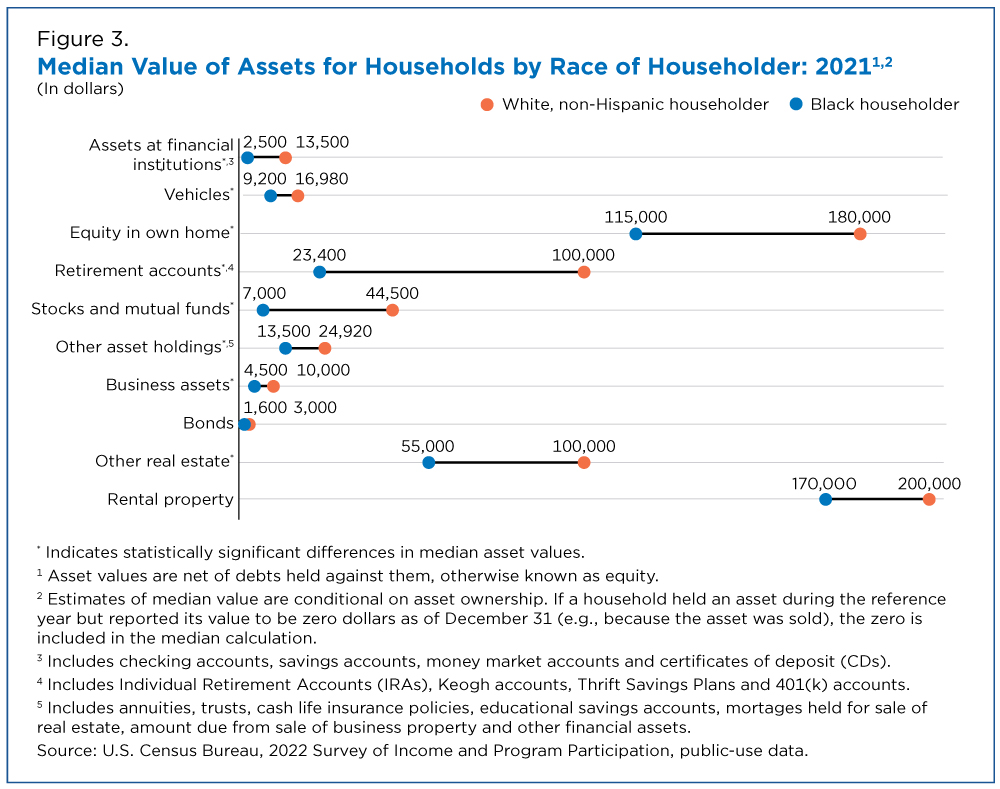

Additionally, median values of most assets held by households with White householders were higher than those held by households with Black householders (Figure 3).

But the magnitude of these differences varied by asset type.

Compared to households with a Black householder, those with a White householder in 2021 were:

- 1.1 times more likely to have assets such as checking and savings accounts at financial institutions (97.8% vs. 89.0%) and, conditional on owning these accounts, had median account values 5.4 times larger ($13,500 and $2,500).

- 1.8 times more likely to own their own home (70.2% vs. 38.6%) and had a median amount of home equity 1.6 times greater ($180,000 vs. $115,000).

- 1.5 times more likely to own at least one retirement account (65.6% vs. 43.9%) with median account values 4.3 times larger ($100,000 vs. $23,400).

- 1.9 times more likely to own stocks and mutual funds (30.9% vs. 16.6%) and had median account values 6.4 times larger ($44,500 vs. $7,000).

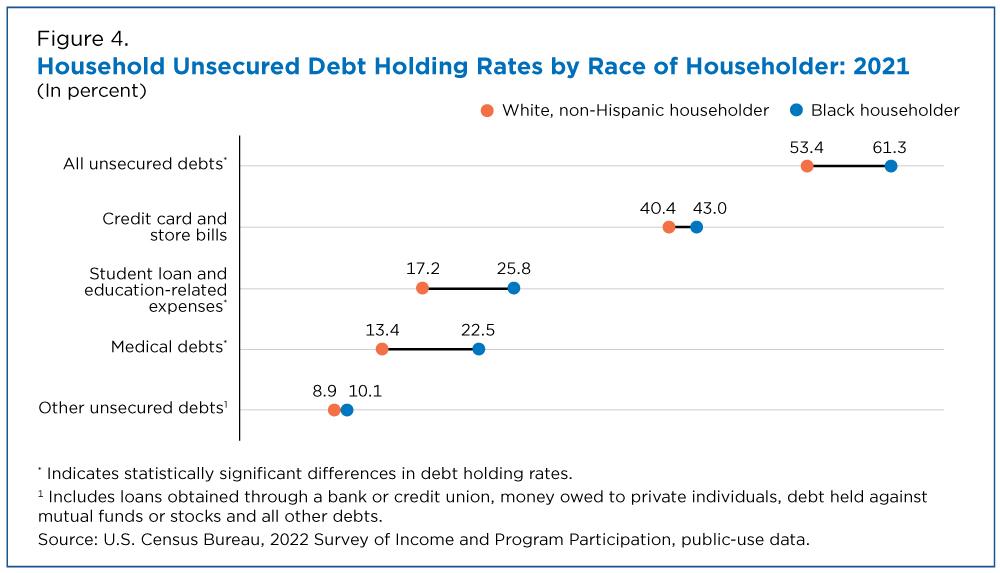

How Unsecured Debt Holding Differs by Race of Householder

Unsecured debts, such as student loans, have no assets backing them. A lender cannot repossess someone’s education if the individual fails to pay a student loan, the way an auto lender might repossess a car.

Unsecured debt can promote or hinder wealth accumulation. For example, student loans can provide individuals access to higher education, which is positively associated with wealth [PDF <1.0 MB], but debt burdens can impede individuals’ ability to invest in wealth-building assets.

Households with a Black householder were more likely than those with a White householder to have unsecured debt (61.3% vs. 53.4%), especially student loan (25.8% vs. 17.2%) and medical debt (22.5% vs. 13.4%).

There were no statistically significant differences in the median amount of medical, student loan and credit card debt. But households with a White householder had more other unsecured debt than those with a Black householder (median amount $6,000 vs. $3,500).

While these median amounts are not statistically different from one another, they are just one measure of debt burden. It’s also necessary to consider measures like resources available to pay down loans and the length debts are held, to better gauge the impact of unsecured debt on the long-term financial security of Black borrowers [PDF 2.0 MB] and on the racial wealth gap.

What is the SIPP?

The Survey of Income and Program Participation is a nationally representative, longitudinal survey administered by the Census Bureau that provides comprehensive information on the dynamics of income, employment, household composition and government program participation.

For technical documentation and more information about SIPP data quality, visit the survey’s Technical Documentation webpage.

Related Statistics

-

Stats for StoriesNational Poverty in America Awareness Month: January 2025The Current Population Survey Annual Social and Economic Supplement reports the official poverty rate in 2023 was 11.1%, not statistically different from 2022.

-

Survey of Income and Program Participation (SIPP)Provides comprehensive information on the dynamics of income, employment, household composition, and government program participation.

-

America Counts: Stories About Income & PovertyExplore various America Counts stories on the topic of income and poverty.

Subscribe

Our email newsletter is sent out on the day we publish a story. Get an alert directly in your inbox to read, share and blog about our newest stories.

Contact our Public Information Office for media inquiries or interviews.

-

Income and PovertyWealth Inequality in the U.S. by Household TypeAugust 01, 2022Census data show persistent inequalities in household wealth in 2019: 38.7% of households did not own a home, and 41.2% did not have a retirement account.

-

Income and Poverty2022 Income Inequality Decreased for First Time Since 2007September 12, 2023U.S. Census Bureau income data released today show declines in real income at the middle and top of the income distribution from 2021 to 2022.

-

Income and PovertyHardships and Wealth Disparities Across Hispanic GroupsSeptember 28, 2022During National Hispanic Heritage Month, we analyze new U.S. Census Bureau data that looks at differences in well-being across detailed Hispanic origin groups.

-

PopulationU.S. Population Growth Slowest Since COVID-19 PandemicJanuary 27, 2026The decline in international migration was felt across the states, though its impact varied.

-

Business and EconomyWho Are the Inventors and Firms That Generate the Most Patents?January 22, 2026Research that links patent inventors to Census Bureau data shows that startups tended to produce fewer but more impactful patents than older firms.

-

Marriage and DivorceThe Long-Term Effects of Divorce on ChildrenJanuary 20, 2026Children of divorce face higher risks of teen pregnancy, incarceration, low income and early death.

-

Business and EconomyExploring New Frontiers With the Quarterly Workforce IndicatorsJanuary 13, 2026New data on employment and hiring for detailed national industries enable data users to explore the composition and dynamics of specialized workforces.