Economic Surveys Show Drop in Supply Delays Since Peak of COVID-19, Higher Prices Due to Inflation

The volatile and complex nature of the challenges businesses faced during the Covid-19 pandemic presented multiple dilemmas for business owners, but two challenges emerged as paramount: supply chain disruptions and Inflation, which started to rise in the spring of 2021 and quickly became a top economic concern.

As the pandemic forced many into isolation, demand for goods and services ebbed and surged in what proved to be a shock to supply chains around the world. While ports bottled up, truck driver shortages worsened and companies struggled to get the raw materials needed to meet demand. Small businesses in particular felt the strain across the United States.

As interest rates rose, inflation eventually started to cool but remained an issue and the U.S. Census Bureau has been tracking the impact on businesses through two near real-time surveys: the most recent, the Business Trends and Outlook Survey (BTOS), and its predecessor, the Small Business Pulse Survey (SBPS).

The SBPS and BTOS matched national indicators of supply chain pressures but also proved to be timelier.

The SBPS published data on a weekly basis to capture the impact of the pandemic on small businesses.

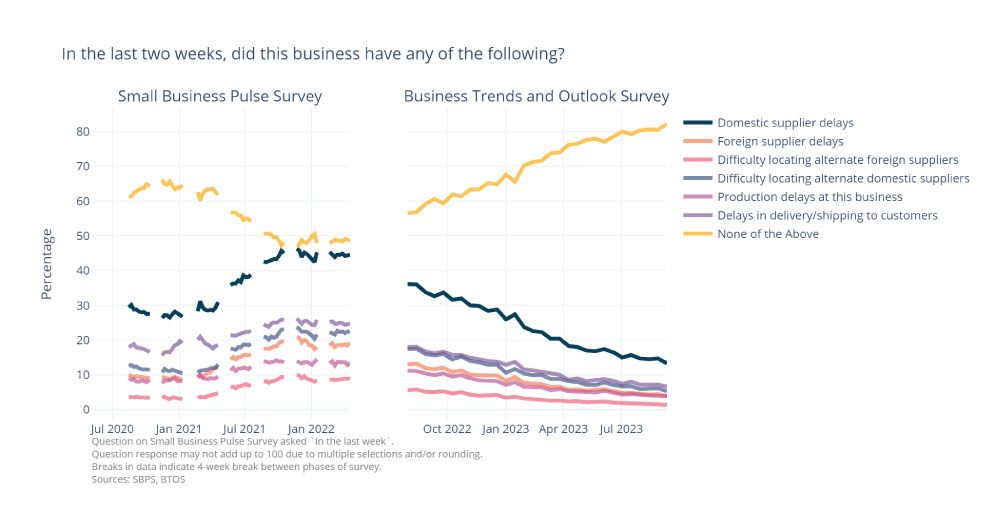

The survey showed that in August 2020, 29.4% of small businesses reported experiencing domestic supplier delays while 10% said they were having foreign supplier delays. By May 2021, domestic supplier delays had significantly increased to 35.8% and again, significantly, to 44.5% by the end of the survey in April 2022.

Foreign supplier delays would similarly see a significant increase over the course of the SBPS, ending at 19.2%.

As the SBPS expanded to the continuous, bi-weekly published BTOS, the collection of supply chain data continued. It showed that supply chain issues persisted for small businesses.

At the start of the BTOS in July 2022, 36.1% of small businesses indicated domestic supplier delays while 13% cited foreign supplier delays.

Since then, the BTOS found that supply chain issues have declined significantly.

Small businesses reported domestic supplier delays dropped from a high of 36.1% in April 2022 to 14.5% during the most recent collection period in July 2023. Foreign supplier delays also dropped significantly to 4.3%.

The SBPS and BTOS matched national indicators of supply chain pressures but also proved to be timelier.

BTOS and Inflation

High inflation also created hardships not only for consumers but for businesses nationwide.

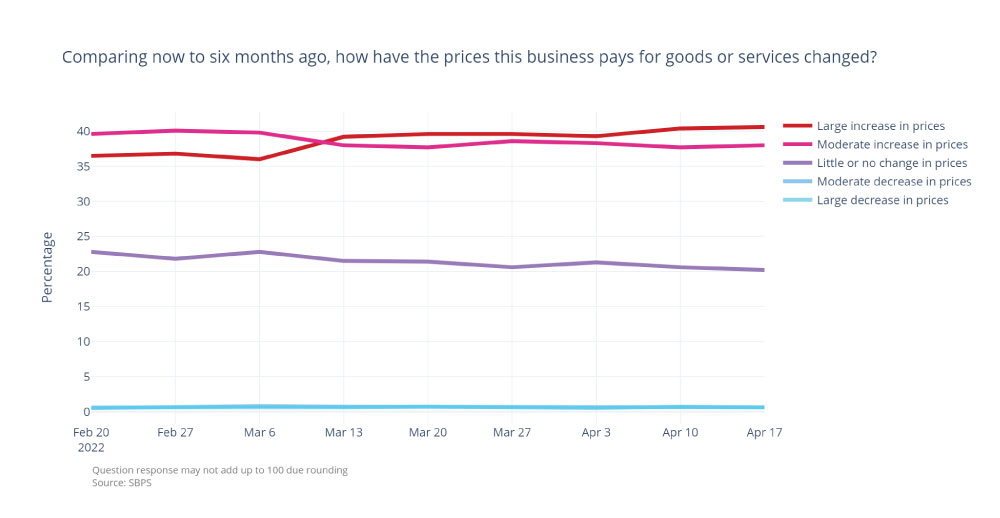

To measure the impact of inflation on small businesses, the SBPS started asking this question in February 2022: “Comparing now to six months ago, how have the prices this business pays for goods and services changed?”.

Initially, 36.5% of respondents indicated a large increase in prices while nearly 40% indicated a moderate increase in prices. By April 2022, the percentage of businesses that reported large price increases jumped to 40.6% while the percentage of those that reported moderate price increases fell to 38%. A stunning 78% of U.S. small businesses reported price increases of any kind.

By the start of the BTOS in July 2022, inflation had become a critical talking point nationally. All eyes turned to monthly indicators of prices and interest rates, the Federal Reserve’s main tool in fighting price hikes. As interest rates rose, inflation dipped but remained an issue and the BTOS continued to track the impact it had on small businesses.

The BTOS asks businesses if in the last two weeks, prices increased, decreased or if there was no change. At the start of the BTOS, 62.8% of businesses responded “increased” while 35.9% said “no change”. Since then, the “increased” category has dropped significantly to 40.0% and the “no change” category has risen significantly to 58.4%.

While still elevated, inflation rates in the U.S. have decreased from pandemic highs. BTOS data appear to back this up: small businesses report they have not noticed decreases in prices.

The SBPS began a successful effort to collect timely and accurate data on the U.S. business climate that proved specifically valuable during COVID-19. The BTOS continues that effort by remaining a high-frequency survey reliable enough to track general trends and nimble enough to pivot during periods of economic crisis.

The updated BTOS scope will continue to expand its coverage to produce a more accurate picture of the national business landscape, collecting data on the impact of natural disasters and producing critical data for government and business leaders.

Get notifications about BTOS publications by signing up for email subscription.

Related Statistics

-

Stats for StoriesSmall Business Week: April 30-May 6, 2023The 2020 County Business Patterns found that 4.4M of all 8.0M establishments in the U.S. had 1 to 4 employees. Just under 200,000 had 100 employees or more.

-

Stats for StoriesMom and Pop Business Owners Day: March 29, 2024The Country Business Patterns program counted 128.3M employment in 2021: 69.4M worked for enterprises with 500+ employees, 59.0M under 500 and 21.5M under 20.

-

Stats for StoriesSmall Business Saturday: November 30, 2024In 2022, there were 8,298,562 U.S. business establishments. Most (7,119,920) had 19 or fewer employees and averaged about 4.4, according to the CBP.

Subscribe

Our email newsletter is sent out on the day we publish a story. Get an alert directly in your inbox to read, share and blog about our newest stories.

Contact our Public Information Office for media inquiries or interviews.

-

Business and EconomyBusiness Trends and Outlook Survey: New Light on Business HealthJune 23, 2022The new BTOS will provide continuous data across geography, business sector, and business size.

-

Business and EconomySmall Business Pulse Survey Reveals Price Increases by SectorNovember 30, 2021Phase 6 wrapped up October 17 and Phase 7 went into the field November 15. Will Phase 7 show that these economic trends are continuing?

-

Business and EconomyCensus Count of U.S. Businesses: Why Responses MatterJanuary 30, 2023The Economic Census, taken every five years, is the most comprehensive survey of businesses in 19 economic sectors and at the national, state and local levels.

-

Income and PovertyNew Snapshots From the Survey of Income and Program ParticipationApril 21, 2025New Census Bureau product offers mobile-friendly fact sheets on who receives income from various sources.

-

PopulationU.S. Metro Areas Experienced Population Growth Between 2023 and 2024April 17, 2025New Census Bureau population estimates show 88% of U.S. metro areas gained population between 2023 and 2024.

-

Business and EconomyWhat Is the Nonemployer Marine Economy?April 09, 2025Thirty states had nonemployer businesses in marine economy sectors, including six states in the Midwest with receipts totaling nearly $11 billion in 2022.

-

Business and EconomyEconomic Census Geographic Area Statistics Data Now AvailableApril 07, 2025A new data visualization based on the 2022 Economic Census shows the changing business landscape of 19 economic sectors across the United States.