Quarterly Services Survey Now Provides Seasonally Adjusted Expense Data for 40 Industries

The U.S. Census Bureau is now publishing seasonally adjusted expense estimates for 40 industries as part of its Quarterly Services Survey, making it easier to gauge whether expenses and revenues are going up or down in consecutive quarters.

It’s a significant move and benefit for economists and policymakers because non-seasonally adjusted expenses can mask underlying trends driven by seasonal shifts.

Now that expense estimates are seasonally adjusted, we can more clearly compare an industry’s expenses with its revenue to see if the estimated gap between them is increasing, decreasing or statistically unchanged.

For instance, social assistance industry revenues typically increase during the fourth quarter, often from charitable giving around the holidays. Analysts use seasonal adjustment procedures to detect underlying trends in an industry with such large revenue increases. These procedures remove the seasonal effects that occur in the same calendar quarter with similar magnitude and direction each year.

Now that expense estimates are seasonally adjusted, we can more clearly compare an industry’s expenses with its revenue to see if the estimated gap between them is increasing, decreasing or statistically unchanged.

The new seasonally adjusted expenses data series in the Quarterly Services Report reveal some interesting patterns during and near the end of the COVID-19 pandemic emergency.

Some industries saw the gap widen between revenue and expenses; some saw no significant differences and others experienced large fluctuations in revenue but not expenses.

All revenue and expenses data contained in this article are seasonally adjusted.

Civic and Social Assistance Organizations

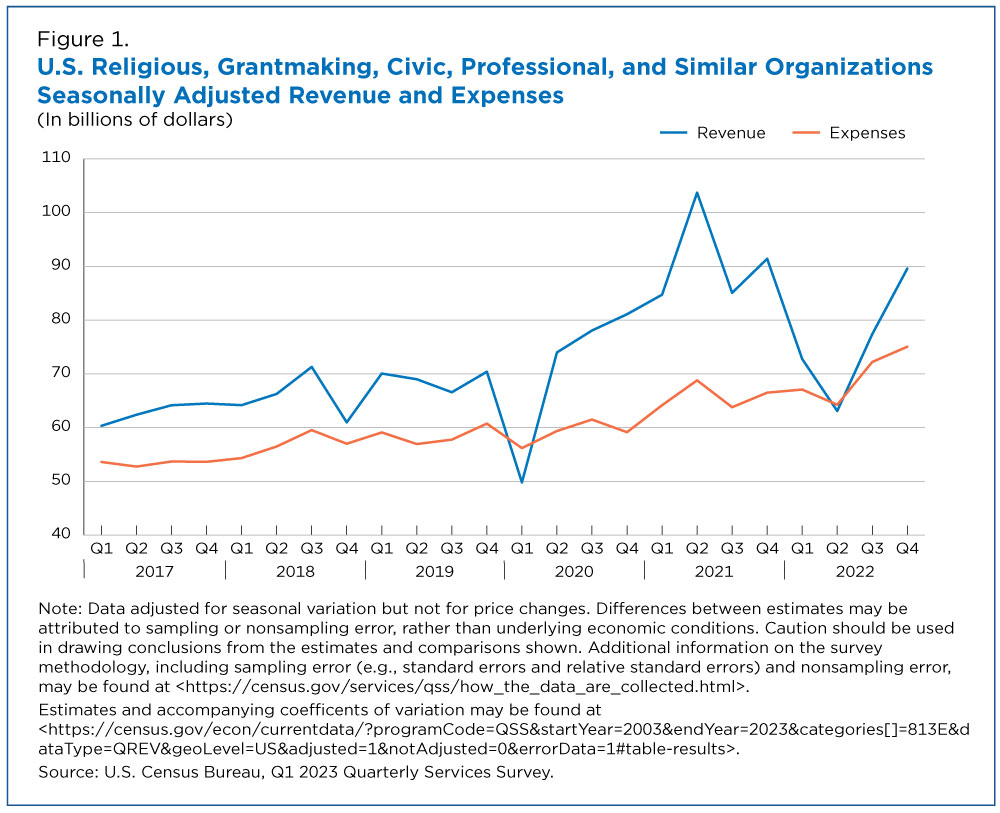

Figure 1 shows revenue and expense data for Religious, Grantmaking, Civic, Professional, and Similar Organizations, a good example of an industry that has had occasional large increases in revenue but smaller changes in expenses.

The new seasonally adjusted data for this industry make it easy to see large, quarter-to-quarter changes and quarters in which revenue and expenses had changes of differing magnitudes.

Specifically, revenue in this industry fell 29.3% from $70.4 billion in the fourth quarter of 2019 to $49.8 billion in the first quarter of 2020, while expenses decreased 7.5% from $60.7 billion to $56.2 billion.

Also noteworthy are quarter-to-quarter trend differences in the second quarter of 2021: revenue increased 22.4% from $84.7 billion to $103.7 billion while expenses rose 7.2%, from $64.1 billion to $68.8 billion.

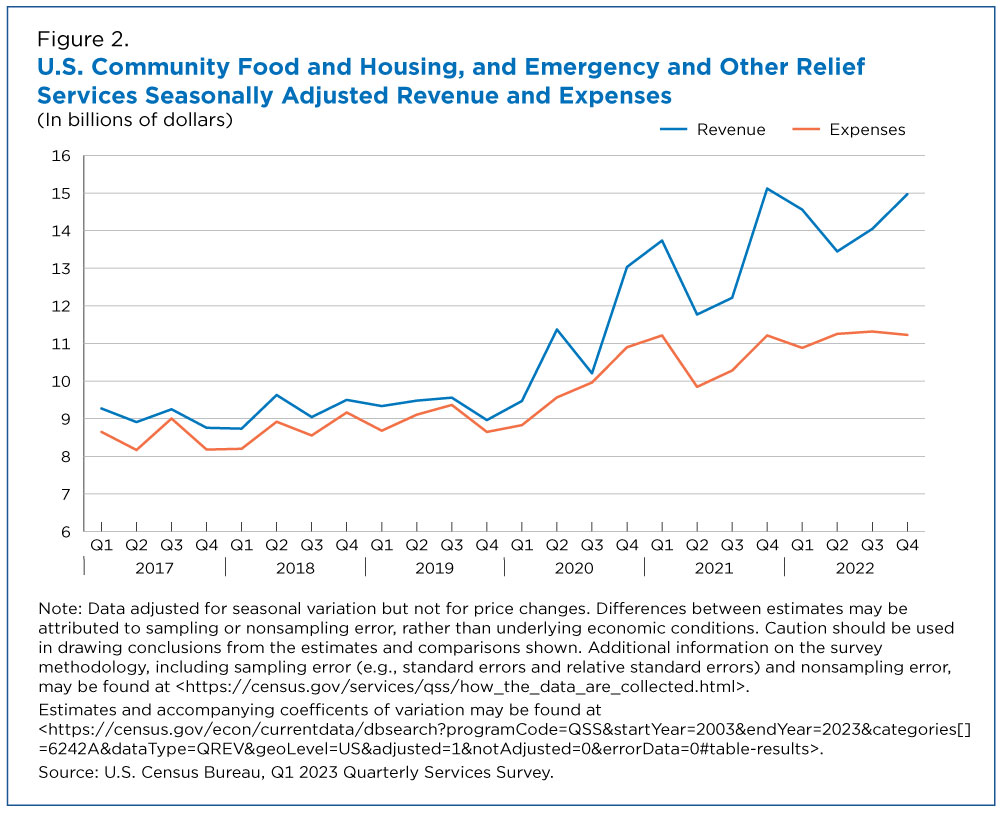

The new seasonally adjusted expense estimates also enable us to see industries where the relationship between revenue and expenses appears to be changing over time (Figure 2). This is the case for Community Food and Housing, and Emergency and Other Relief Services.

From 2017 to 2019, the estimated revenue and expense levels for this industry were within a billion dollars of each other.

The revenue estimate for the fourth quarter of 2017 was $8.8 billion while the expenses estimate was $8.2 billion. Two years later, the estimates for the fourth quarter of 2019 were still within $1.0 billion of each other: $9.0 billion in revenue and $8.6 billion in expenses. (The estimates for 2019Q4 are not statistically different at the 90% confidence level.)

However, the industry’s revenue and expense estimates often were not within $1.0 billion of each other after the COVID-19 pandemic hit in March 2020. During the fourth quarter of 2020, the gap between them grew notably compared with pre-pandemic quarters: revenue was $13.0 billion and expenses $10.9 billion.

Over the next two years, the gap between revenue and expenses remained larger than $1.0 billion, ranging from approximately $1.9 billion to $3.9 billion. Revenue and expenses for fourth quarter of 2021 were $15.1 billion and $11.2 billion, respectively. Another year later, fourth quarter 2022 revenue was $15.0 billion and expenses $11.2 billion.

Health Care

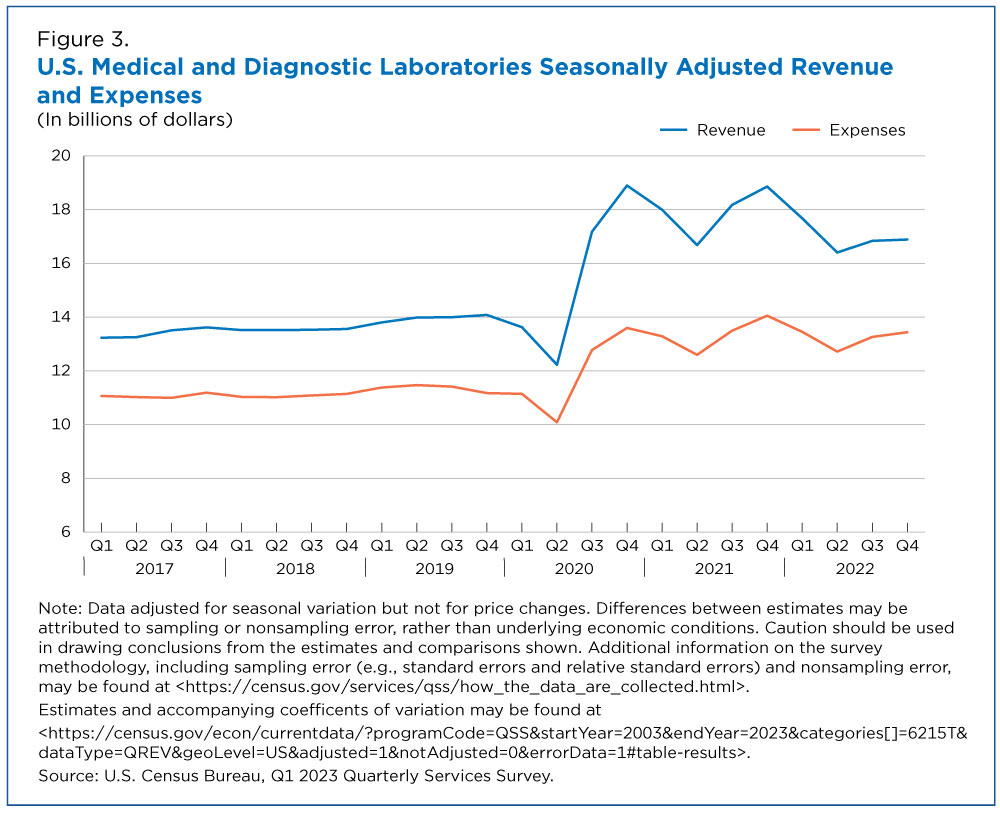

The new seasonally adjusted expenses data also highlight interesting trends in Medical and Diagnostic Laboratories revenue and expenses estimates after 2020, the first year of the pandemic.

With the seasonal spikes smoothed out, it became clear that previous revenue estimates were often $2.5 billion more than their corresponding expenses estimates (Figure 3).

After coronavirus testing became more widely available in the second half of 2020, the difference between quarterly revenue and expense estimates generally widened, ranging from approximately $3.5 billion to $5.3 billion.

The revenue estimate for the first quarter of 2019 was $13.8 billion and the expense estimate $11.4 billion, a difference of $2.4 billion. Two years later, the difference between revenue and expense estimates ($4.7 billion) was much larger – revenue was $18.0 billion and expenses $13.3 billion.

In the fourth quarter of 2022, after the peak of the pandemic, estimated revenue was $16.9 billion and estimated expenses $13.4 billion, which is not statistically different from the gap between them in the fourth quarter of 2019.

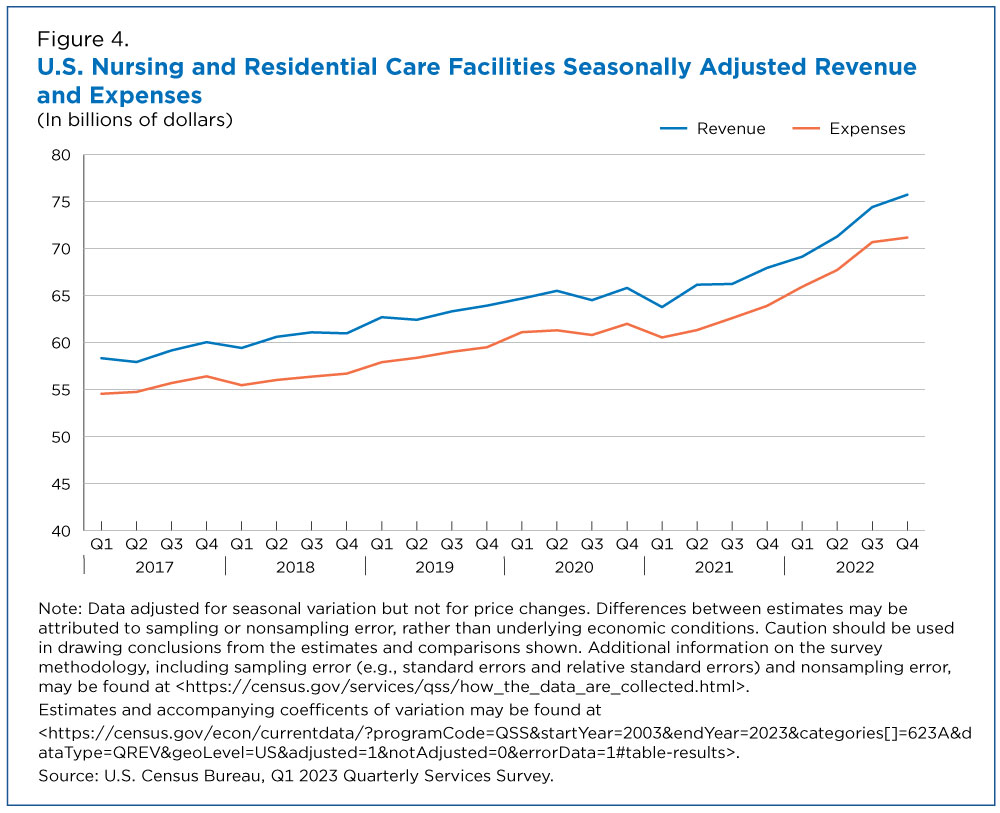

But not every health care industry experienced growing gaps between revenue and expenses during the pandemic. Nursing and Residential Care Facilities, for example, generally maintained similar differences in revenue and expense levels they’d had since 2017.

In the fourth quarter of 2019, the revenue and expense estimates were $63.9 billion and $59.5 billion, respectively. Two years later, in the fourth quarter of 2021, the estimates were $68.0 billion and $63.9 billion, respectively. Moving ahead to the fourth quarter of 2022, revenue was $75.7 billion and expenses $71.2 billion.

Whether alone or in combination with revenue, the new seasonally adjusted expenses data provide a clearer view of underlying economic trends impacted by seasonal changes and unusual events.

Related Statistics

Stats for Stories

Stats for Stories

Subscribe

Our email newsletter is sent out on the day we publish a story. Get an alert directly in your inbox to read, share and blog about our newest stories.

Contact our Public Information Office for media inquiries or interviews.