Homeowner and Rental Vacancy Rates Declined During COVID-19 Pandemic

Housing vacancy rates — both for homeowner and rental housing — are at or near historic lows, according to the U.S. Census Bureau’s recently released Housing Vacancy Survey (HVS).

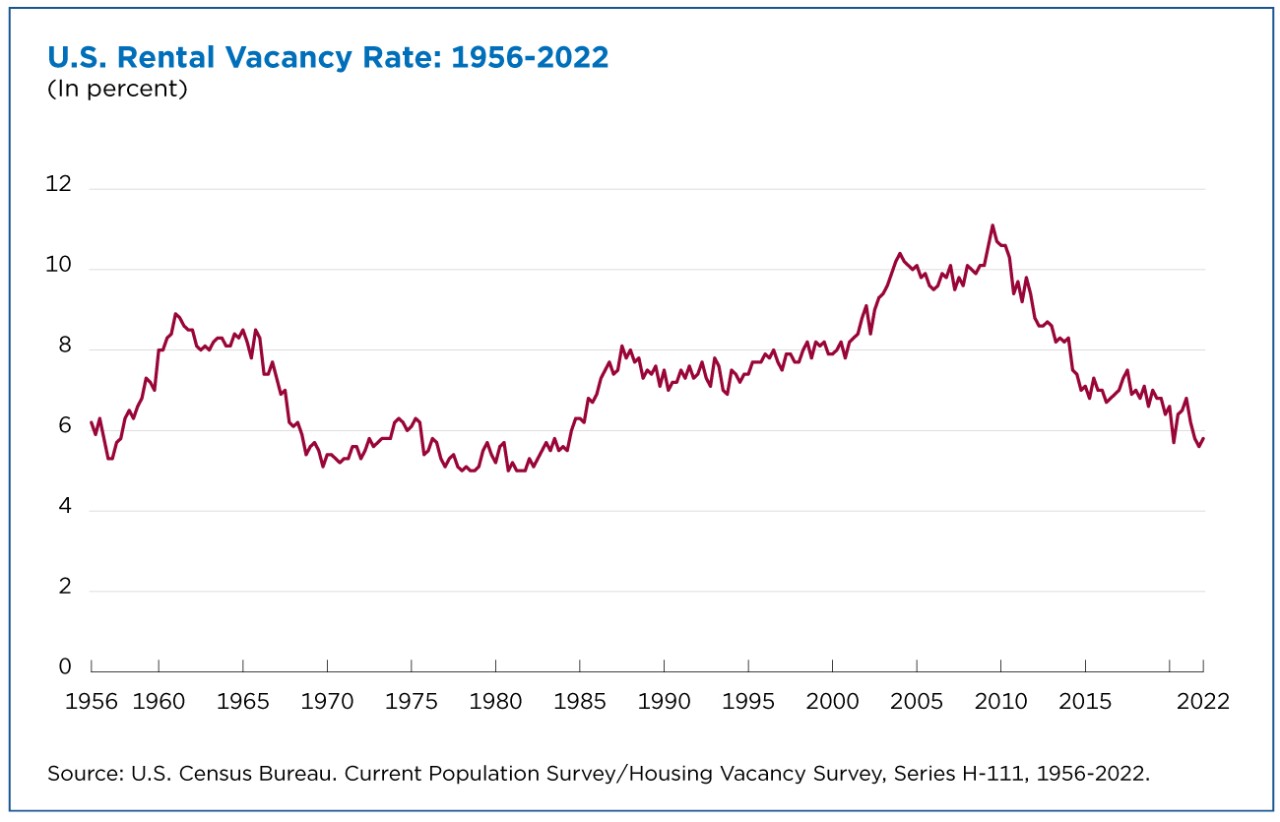

Vacancy rates for rental housing are lower than at any point during the 35-year period from 1985 until the start of the COVID-19 pandemic in early 2020. The vacancy rate for homeowner housing is lower than at any point from 1980 until early 2020.

Both rental and homeowner vacancy rates decreased between 2009 and 2019 as the nation recovered from the foreclosure crisis. Housing supply then tightened further during the COVID-19 pandemic.

The Census Bureau has collected the Housing Vacancy Survey since 1956 (as a supplement to the Current Population Survey) to provide quarterly estimates of the rental vacancy rate and the homeowner vacancy rate.

Both rental and homeowner vacancy rates decreased between 2009 and 2019 as the nation recovered from the foreclosure crisis. Housing supply then tightened further during the COVID-19 pandemic.

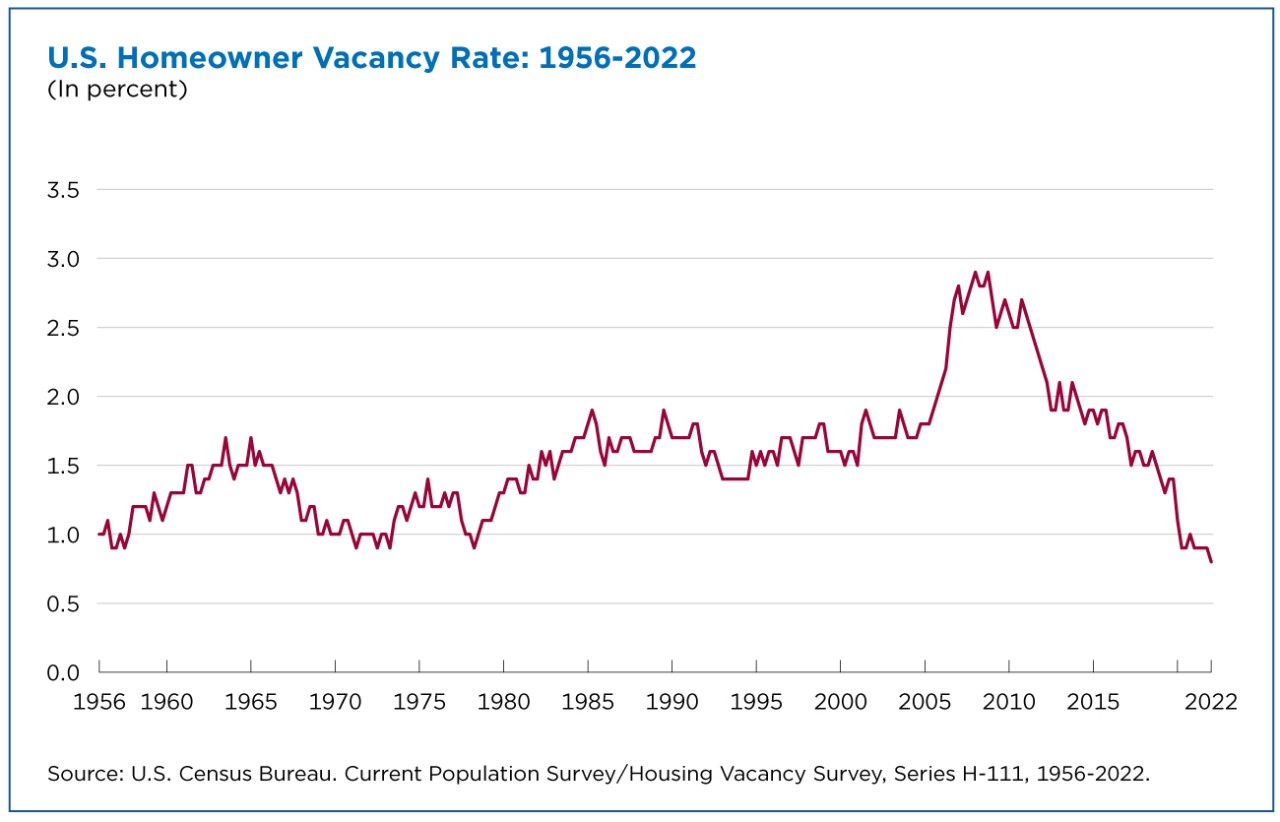

Few Homes for Sale

The homeowner vacancy rate in the first quarter of 2022 was 0.8%.

This is the first time in the 66-year history of the HVS that the homeowner vacancy rate has been as low as 0.8%. Although not statistically different from previous lows of 0.9% (which occurred prior to 1980 and in 2020-2021 during the pandemic), it is lower than at any point during the 40-year period from 1980 until the start of the COVID-19 pandemic in early 2020.

Prior to the pandemic, the quarterly homeowner vacancy rate estimate dipped to 0.9% only seven times in six years (1978, 1973, 1972, 1971, 1957, and 1956).

Low Rental Vacancy

The rental vacancy rate in the first quarter of 2022 was 5.8% — higher than the historical low of 5.0% recorded prior to 1985.

However, it was lower than the quarterly rental vacancy rate estimate at any point during the 35-year period from 1985 through 2019.

Foreclosure Crisis and Recovery

The most current vacancy rate estimates reflect tightening housing market conditions over the decade from 2009 to 2019, as the nation recovered from the foreclosure crisis.

The homeowner vacancy rate increased from 1.6% in the fourth quarter of 2000 to 2.7% in the fourth quarter of 2009 during the housing boom and foreclosure crisis. It then declined to 1.4% in the fourth quarter of 2019, just before the COVID-19 pandemic hit the United States.

The rental vacancy rate also increased from 7.8% in the fourth quarter of 2000 to 10.7% in the fourth quarter of 2009, before dropping to 6.4% in the last quarter of 2019.

In both cases, tightening housing market conditions from 2009 and 2019 left vacancy rates lower in the fourth quarter of 2019 than they had been in 2000 prior to the housing boom and subsequent foreclosure crisis.

Pandemic Impact

Housing availability declined further as households adjusted to the changes prompted by the pandemic.

At the same time, safety considerations and local guidelines led to temporary changes in HVS data collection procedures, complicating interpretation of the estimates for the early quarters of the pandemic period.

A recent Census Bureau working paper provides additional information about how HVS data collection procedures changed and the potential implications for the vacancy rate estimates.

The changes were most widespread during the second and third quarters of 2020. However, they affected data collection procedures in at least some localities between the first quarter of 2020 and the third quarter of 2021.

By the fourth quarter of 2021, data collection had returned to standard procedures in all areas.

Before and After COVID

Comparing the most current vacancy rate estimates to the period just prior to the COVID-19 pandemic shows just how tight the housing market has become during the pandemic.

The homeowner vacancy rate declined 0.6 percentage points between the fourth quarter of 2019 and the first quarter of 2022, from 1.4% to 0.8%.

The rental vacancy rate also declined 0.6 percentage points during the same period, from 6.4% to 5.8%.

Taken together, the homeowner and rental vacancy rate estimates for the first quarter of 2022 indicate that housing availability was extremely low by historical standards.

It’s not clear what happens next. The housing market is adapting to rising mortgage interest rates and there is still uncertainty about economic conditions and the next phase of the pandemic.

Future quarterly releases and more data about vacancy rates and the housing inventory can be found on the HVS webpage.

Each quarterly HVS release includes more detailed information about the characteristics of vacant housing units, as well as how vacancy rates vary across different types of housing. Vacancy rate estimates are also available for the 75 largest metropolitan statistical areas and for the 50 states and Washington, D.C.

Definitions and more information about the HVS’s methodology, confidentiality protection, and sampling and nonsampling error are also available on the HVS webpage.

Related Statistics

-

Stats for StoriesAmerican Housing Month: June 2023The 2021 American Community Survey counted 142.15M housing units, up 3.61M from 2018, and up 10.36M from 131.79M in 2010.

-

Housing Vacancies and Homeownership (CPS/HVS)Provides current information on the rental and homeowner vacancy rates, and characteristics of units available for occupancy.

Subscribe

Our email newsletter is sent out on the day we publish a story. Get an alert directly in your inbox to read, share and blog about our newest stories.

Contact our Public Information Office for media inquiries or interviews.

-

America Counts StoryGrowth in Housing Units Slowed in the Last DecadeAugust 12, 2021The 2020 Census results released today provide a count of vacant and occupied housing units across the nation.

-

America Counts StoryZillow and Census Bureau Data Show Pandemic’s Impact on Housing MarketOctober 04, 2021The housing market stalled in spring 2020 but rebounded by summer.

-

America Counts StoryCensus Bureau Construction Data: From Stone Age to Space AgeFebruary 08, 2022The U.S. Census Bureau is phasing in improvements, including satellite imaging, to improve construction data products that are key federal economic indicators.

-

America Counts StoryU.S. Housing Vacancy Rate Declined in Past DecadeAugust 12, 2021The percentage of housing units vacant in 2020 dropped to 9.7% from 11.4% in 2010, according to 2020 Census data released this week.

-

EmploymentThe Stories Behind Census Numbers in 2025December 22, 2025A year-end review of America Counts stories on everything from families and housing to business and income.

-

Families and Living ArrangementsMore First-Time Moms Live With an Unmarried PartnerDecember 16, 2025About a quarter of all first-time mothers were cohabiting at the time of childbirth in the early 2020s. College-educated moms were more likely to be married.

-

Business and EconomyState Governments Parlay Sports Betting Into Tax WindfallDecember 10, 2025Total state-level sports betting tax revenues has increased 382% since the third quarter of 2021, when data collection began.

-

EmploymentU.S. Workforce is Aging, Especially in Some FirmsDecember 02, 2025Firms in sectors like utilities and manufacturing and states like Maine are more likely to have a high share of workers over age 55.