Parents With Young Children Used Child Tax Credit Payments for Child Care

Three in 10 families that received monthly Advance Child Tax Credit (CTC) payments spent them on kids’ school expenses, and 1 in 4 families with young children used them to cover child care costs, according to new results from the U.S. Census Bureau’s experimental Household Pulse Survey (HPS).

The Internal Revenue Service (IRS) began issuing a monthly Advance Child Tax Credit payment to families with children in mid-July and this story discusses how families used the first three of the six checks.

Families with at least one school-age child were more likely to spend the CTC on school expenses than families with only children under 5 years old.

According to the IRS, about 35 million eligible families received up to $300 for each child under age 6 and up to $250 for each child ages 6 to 17 in July, August, and September. These payments will continue every month through December.

In this story, we show estimates of how the CTC was used by adults in households that responded to the HPS in July, August, or September and focus on uses of the CTC that directly or indirectly impact children.

Some Using Child Tax Credit to Pay Off Debt

The HPS asked adults in households whether they had received a CTC payment within the last four weeks. If they had, they were then asked to identify whether they mostly spent the CTC, mostly saved or mostly used it to pay off debt.

About 4 in 10 households that received the first three CTC checks (from late July to late September) said they mostly used them to pay off debt.

The share of respondents that reported “mostly spending” them increased from 27% to 33% during that period, in line with prior research that found that the CTC decreased household economic hardships, and that households with children were hardest hit during the pandemic.

When Schools Opened, More Used CTC For School Expenses

Adults who reported receiving a CTC payment were also asked a separate question about what they had spent the money on, allowing them to pick multiple choices from rent to groceries. The majority of HPS respondents reported spending their CTC checks on more than one thing.

Several choices were school-related expenses, including books and supplies, tuition, tutoring services, after-school programs (other than tutoring and child care) and transportation to/from school.

Reported spending over time shows that households were more likely to say they spent the CTC for school expenses towards the end of August and into early September, as the school year began across the country, than in late July and early August. But there was no difference between the share of households that spent their CTC on school expenses in late August and early September.

By late September, adults in households that received the CTC were less likely to spend part of it on school-related expenses than early in the month.

About 1 in 10 households used the CTC for child care: 10% in late July, increasing to 11% in late September.

Many families also spent the CTC on the basics. From late July through September, around half of CTC recipients reported spending at least part of it on food and about 4 in 10 on rent, mortgage or utilities.

Different Spending by Race and Hispanic Origin

The share of non-Hispanic White, non-Hispanic Black and Hispanic families that used the CTC for school-related expenses increased from July through early September.

However, non-Hispanic Black and Hispanic families used the CTC for school expenses in much higher proportions than non-Hispanic White households.

By late September, an estimated 4 in 10 Black families (42%) and 3 in 10 Hispanic families (31%) used the CTC for school expenses, compared to about 1 in 4 non-Hispanic White families (26%).

Spending Varies by Ages of Children

Many families reported spending the CTC on child care and school-related expenses. But the pattern of spending varied by the ages of the children in the family.

Families with at least one school-age child were more likely to spend the CTC on school expenses than families with only children under 5 years old.

But families that only had young children were much more likely to spend it on child care — 1 in 5 in late July and 1 in 4 from early August to late September.

Although small, the increase in use of the CTC for child care among families with young kids between late July (22%) and late September (26%) may be linked to the beginning of the school year and parents’ work.

It is clear that families used the first three CTC payments to cover basic expenses, like food and rent that benefit everyone in the household, and more specifically to cover children’s school and child care expenses, especially as the school year began.

Advance Child Tax Credit

Several changes were made to the child tax credit as part of the American Rescue Plan Act of 2021, COVID-19 relief legislation that was signed into law in March.

The program provides the tax credit to all parents with children, including those who are not required to file a federal tax return.

In addition, the credit was increased — up to $3,600 per year for children ages 5 and under at the end of this year; and up to $3,000 a year for those ages 6 to 17, on a sliding scale based on income. Half of the annual credit amount is being paid out in advance through the monthly checks.

About the Household Pulse Survey

The HPS is designed to provide near real-time data on how the pandemic is affecting Americans’ lives. Information on the methodology and reliability of these estimates can be found in the source and accuracy statements for each data release.

Data users interested in state-level sample sizes, the number of respondents, weighted response rates and occupied housing unit coverage ratios can consult the quality measures file available at the same location.

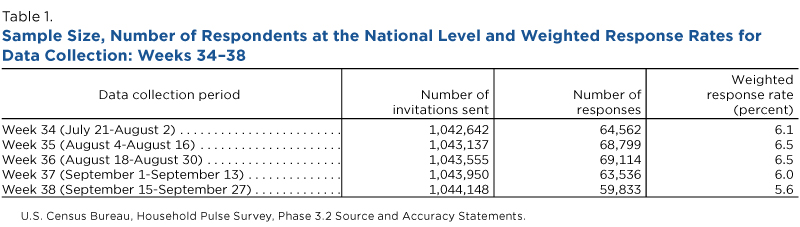

These data were collected over five data weeks from July 21 to September 27 of the survey, which was sent to more than 1 million adults in households every two weeks.

Daniel J. Perez-Lopez and Yerís Mayol-García are survey statisticians in the Census Bureau’s Social, Economic, and Housing Statistics Division.

Related Statistics

-

Stats for StoriesBack to School: August 2023The October 2021 Current Population Survey found 73.8 million total students enrolled in school, which is 23.5 percent of the population 3 years and older.

-

Stats for StoriesNational Child's Day: November 20, 2023In 2021, the majority (71%) of America’s 72.3M children under 18 lived with two parents and the next largest share (20.9%) lived with their mothers only.

-

Stats for StoriesNational Parents’ Day: July 23, 2023Of the 63.2M parents living with their children <18, 76.1% lived with a spouse, 15.1% had no spouse/partner present. The rest lived with a cohabiting partner.

-

Stats for StoriesNational Single Parent Day: March 21, 2024The Current Population Survey (CPS) estimates there were 9.8M one-parent households (7.3M mother only and 2.5M father only) in 2023, compared to 1.5M in 1950.

Subscribe

Our email newsletter is sent out on the day we publish a story. Get an alert directly in your inbox to read, share and blog about our newest stories.

Contact our Public Information Office for media inquiries or interviews.

-

America Counts StoryFamilies Saw Less Economic Hardship as Child Tax Credit Payments CameAugust 11, 2021Household Pulse Survey collected responses just before and just after the arrival of the first CTC checks.

-

America Counts StoryHouseholds with Kids More Likely to Report Income Loss During COVID-19May 27, 2020The U.S. Census Bureau’s new Household Pulse Survey shows that adults living with children are especially likely to experience lost income and food shortages.

-

America Counts StoryMany American Households Use Stimulus Payments to Pay Down DebtMarch 24, 2021Millions of Americans are poised to receive a third stimulus check, one of the benefits of the American Rescue Plan Act. Many have used stimulus to pay debt.

-

Business and EconomyEconomic Census Geographic Area Statistics Data Now AvailableApril 07, 2025A new data visualization based on the 2022 Economic Census shows the changing business landscape of 19 economic sectors across the United States.

-

Income and PovertyWhat Sources of Income Do People Rely On?April 02, 2025A new interactive data tool shows income sources for hundreds of demographic and economic characteristic combinations.

-

Business and EconomyBig Improvements to the Annual Integrated Economic Survey (AIES)March 26, 2025The Census Bureau is making several changes and enhancements to capture 2024 economic data based on feedback from last year’s survey.

-

PopulationOnly 50 U.S. Counties Had Populations Over a Million in 2024March 17, 2025A new data visualization highlights U.S. counties between 1970 and 2024 whose populations ever surpassed a million.