For Immediate Release: Wednesday, September 12, 2018

Income, Poverty and Health Insurance Coverage in the United States: 2017

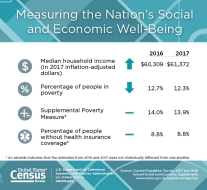

SEPT. 12, 2018 — The U.S. Census Bureau announced today that real median household income increased by 1.8 percent between 2016 and 2017, while the official poverty rate decreased 0.4 percentage points. At the same time, the number of people without health insurance coverage and the uninsured rate were not statistically different from 2016.

Median household income in the United States in 2017 was $61,372, an increase in real terms of 1.8 percent from the 2016 median income of $60,309. This is the third consecutive annual increase in median household income.

The nation’s official poverty rate in 2017 was 12.3 percent, with 39.7 million people in poverty. The number of people in poverty in 2017 was not statistically different from the number in poverty in 2016. The 0.4 percentage-point decrease in the poverty rate from 2016 (12.7 percent) to 2017 represents the third consecutive annual decline in poverty. Since 2014, the poverty rate has fallen 2.5 percentage points, from 14.8 percent to 12.3 percent.

The percentage of people without health insurance coverage for the entire 2017 calendar year was 8.8 percent, or 28.5 million, not statistically different from 2016 (8.8 percent or 28.1 million people). Between 2016 and 2017, the number of people with health insurance coverage increased by 2.3 million, up to 294.6 million.

These findings are contained in two reports: Income and Poverty in the United States: 2017 and Health Insurance Coverage in the United States: 2017.

Another Census Bureau report, The Supplemental Poverty Measure: 2017, was also released today. The supplemental poverty rate in 2017 was 13.9 percent, not statistically different from the 2016 supplemental poverty rate of 14.0 percent. The Supplemental Poverty Measure (SPM) provides an alternative way of measuring poverty in the United States and serves as an additional indicator of economic well-being. The Census Bureau has published poverty estimates using the SPM annually since 2011 with the collaboration of the Bureau of Labor Statistics.

The Current Population Survey, sponsored jointly by the Census Bureau and Bureau of Labor Statistics, is conducted every month and is the primary source of labor force statistics for the U.S. population; it is used to calculate the monthly unemployment rate estimates. Supplements are added in most months; the Annual Social and Economic Supplement is designed to give annual, national estimates of income, poverty and health insurance numbers and rates. The most recent Annual Social and Economic Supplement was conducted nationwide (February, March and April 2018) and collected information about income and health insurance coverage during the 2017 calendar year.

The Current Population Survey-based income and poverty report includes comparisons with the previous year, and historical tables in the report contain statistics back to 1959. The health insurance report is based on both the Current Population Survey and the American Community Survey. State and local income, poverty and health insurance estimates will be released Thursday, Sept. 13, from the American Community Survey.

Income

- Median household income in the United States in 2017 was $61,372, an increase in real terms of 1.8 percent from the 2016 median income of $60,309. This is the third consecutive annual increase in median household income.

- The 2017 real median income of family households increased 1.4 percent from 2016 to $77,713. Real median income for married-couple households increased 1.6 percent between 2016 and 2017. The difference between the 2016-2017 percentage change in median income for family households (1.4 percent) and married-couple households (1.6 percent) was not statistically significant. (A family household is a household with a householder who is related to a least one other person in the household by birth, marriage or adoption.)

Race and Hispanic Origin

(Race data refer to people reporting a single race only; Hispanics can be of any race.)

- The real median income of households maintained by non-Hispanic whites ($68,145) and Hispanics ($50,486) increased 2.6 percent and 3.7 percent, respectively, between 2016 and 2017. This is the third annual increase in median household income for these two groups. Among the race groups, households maintained by Asians had the highest median income in 2017, $81,331. The differences between the 2016-2017 percentage changes in median income for non-Hispanic white (2.6 percent) and Hispanic (3.7 percent) households were not statistically significant.

Nativity

- The real median income of households maintained by a native-born person increased 1.5 percent between 2016 and 2017, while the 2017 real median income of households maintained by a foreign-born person was not statistically different from 2016. The difference between the 2016-2017 percentage changes in median income for households maintained by a foreign-born person and those maintained by a native-born person was not statistically significant.

Earnings

- The 2017 real median earnings of all male workers increased 3.0 percent from 2016 to $44,408, while real median earnings for their female counterparts ($31,610) saw no statistically significant change between 2016 and 2017.

- In 2017, the real median earnings of men ($52,146) and women ($41,977) working full-time, year-round each decreased from their respective 2016 medians by 1.1 percent. The 2017 female-to-male earnings ratio was 0.805, not statistically different from the 2016 ratio. The difference between the 2016-2017 percentage change in median earnings for men and women working full-time, year-round was not statistically significant.

- The number of men and women working full-time, year-round increased by 1.4 million and 1.0 million, respectively, between 2016 and 2017. The difference between the 2016-2017 increases in the number of men and women working full-time, year-round was not statistically significant.

Poverty

- The official poverty rate in 2017 was 12.3 percent, down 0.4 percentage points from 12.7 percent in 2016. This is the third consecutive annual decline in poverty. Since 2014, the poverty rate has fallen 2.5 percentage points, from 14.8 percent to 12.3 percent.

- In 2017, there were 39.7 million people in poverty, not statistically different from the number in poverty in 2016.

- From 2016 to 2017, the number of people in poverty decreased for people in families; people living in the West; people living outside metropolitan statistical areas; all workers; workers who worked less than full-time, year-round; people with a disability; people with a high school diploma but no college degree; and people with some college but no degree.

Age

- Between 2016 and 2017, the poverty rate for adults ages 18 to 64 declined 0.4 percentage points, from 11.6 percent to 11.2 percent, while poverty rates for individuals under age 18 and for people age 65 and older were not statistically different from 2016.

Education

- Between 2016 and 2017, people with at least a bachelor's degree were the only group to have an increase in the poverty rate or the number of people in poverty. Among this group, the poverty rate increased 0.3 percentage points and the number in poverty increased by 363,000 individuals between 2016 and 2017. Even with this increase, among educational attainment groups, people with at least a bachelor’s degree had the lowest poverty rates in 2017.

Supplemental Poverty Measure

The Supplemental Poverty Measure (SPM) extends the official poverty measure by taking into account many of the government programs designed to assist low-income families and individuals that are not included in the current official poverty measure.

The SPM released today shows:

- In 2017, the overall SPM rate was 13.9 percent. This is not statistically different from the 2016 SPM rate of 14.0.

- The SPM rate for 2017 was 1.6 percentage points higher than the official poverty rate of 12.3 percent.

- There were 16 states plus the District of Columbia for which SPM rates were higher than official poverty rates, 18 states with lower rates, and 16 states for which the differences were not statistically significant.

- Social Security continued to be the most important anti-poverty program, moving 27.0 million individuals out of poverty. Refundable tax credits moved 8.3 million people out of poverty.

Age

- SPM rates were not statistically different for any of the major age categories in 2017 compared with 2016. SPM rates for individuals under age 18 were 15.6 percent, which is not statistically different than 15.2 percent in 2016.

- The percentage of individuals age 65 and older with SPM resources below half their SPM threshold was 4.9 percent in 2017.

While the official poverty measure includes only pretax money income, the supplemental poverty measure adds the value of in-kind benefits, such as the Supplemental Nutrition Assistance Program, school lunches, housing assistance and refundable tax credits.

Additionally, the SPM deducts necessary expenses for critical goods and services from income. Expenses that are deducted include: taxes, child care, commuting expenses, contributions toward the cost of medical care and health insurance premiums, and child support paid to another household. The SPM permits the examination of the effects of government transfers on poverty estimates. For example, not including refundable tax credits (the Earned Income Tax Credit and the refundable portion of the child tax credit) in resources, the poverty rate for all people would have been 16.5 percent rather than 13.9 percent. The SPM does not replace the official poverty measure and will not be used to determine eligibility for government programs.

Health Insurance

- In 2017, 8.8 percent of people, or 28.5 million, did not have health insurance at any point during the year. The uninsured rate and number of uninsured in 2017 were not statistically different from 2016 (8.8 percent or 28.1 million).

- The percentage of people with health insurance coverage for all or part of 2017 was 91.2 percent, not statistically different from the rate in 2016 (91.2 percent). Between 2016 and 2017, the number of people with health insurance coverage increased by 2.3 million, up to 294.6 million.

- Between 2016 and 2017, the percentage of people without health insurance coverage at the time of interview decreased in three states and increased in 14 states.

Coverage Types

- In 2017, private health insurance coverage continued to be more prevalent than government coverage, at 67.2 percent and 37.7 percent, respectively. Of the subtypes of health insurance coverage, employer-based insurance was the most common, covering 56.0 percent of the population for some or all of the calendar year, followed by Medicaid (19.3 percent), Medicare (17.2 percent), direct-purchase coverage (16.0 percent), and military coverage (4.8 percent).

- Between 2016 and 2017, the rate of Medicare coverage among all people increased by 0.6 percentage points to cover 17.2 percent of people for part or all of 2017 (up from 16.7 percent in 2016). This increase was partly due to growth in the number of people age 65 and over. The population 65 years and older did not have a statistically significant change in the Medicare coverage rate between 2016 and 2017. However, the percentage of the U.S. population 65 years and older increased between 2016 and 2017.

- The military coverage rate increased by 0.2 percentage points to 4.8 percent during this time. Coverage rates for employment-based coverage, direct-purchase coverage, and Medicaid did not statistically change between 2016 and 2017.

Age

- In 2017, the percentage of uninsured children under age 19 (5.4 percent) was not statistically different from the percentage in 2016.

- For children under age 19 in poverty, the uninsured rate (7.8 percent) was higher than for children not in poverty (4.9 percent).

- In 2017, adults age 65 and over and children under age 19 were more likely to have had health insurance coverage (98.7 percent and 94.6 percent, respectively) compared with adults ages 19 to 64 (87.8 percent).

Race and Hispanic Origin

(Race data refer to people reporting a single race only; Hispanics can be of any race.)

- Between 2016 and 2017, the uninsured rate did not statistically change for any race or Hispanic origin group.

- In 2017, non-Hispanic whites had the lowest uninsured rate among race and Hispanic-origin groups (6.3 percent). The uninsured rates for blacks and Asians were 10.6 percent and 7.3 percent, respectively. Hispanics had the highest uninsured rate (16.1 percent).

Regional trends are available for income, poverty and health insurance in each respective report, as well as state level data for health insurance.

State and Local Estimates From the American Community Survey

State-level health insurance data from the American Community Survey are included in this report. On Thursday, Sept.13, the Census Bureau will release all 2017 single-year estimates of median household income, poverty and health insurance for all states, counties, places and other geographic units with populations of 65,000 or more from the American Community Survey. These statistics will include numerous social, economic and housing characteristics, such as language, education, commuting, employment, mortgage status and rent. Subscribers will be able to access these estimates on an embargoed basis.

The American Community Survey provides a wide range of important statistics about people and housing for every community (i.e., census tracts or neighborhoods) across the nation. The results are used by everyone from town and city planners to retailers and homebuilders. The survey is the only source of local estimates for most of the 40 topics it covers.

The Current Population Survey Annual Social and Economic Supplement and American Community Survey are subject to sampling and nonsampling errors. All comparisons made in each respective report have been tested and found to be statistically significant at the 90 percent confidence level, unless otherwise noted.

For additional information on the source of the data and accuracy of the Income, Poverty and Health Insurance estimates, visit <https://www2.census.gov/library/publications/2018/demo/p60-263sa.pdf>.

###