Does Doubling Up Improve Family Well-Being?

Does Doubling Up Improve Family Well-Being?

Studies have shown that “doubling up,” or sharing housing, increased during the last economic recession and is most common in low-income families. Yet, we do not really know whether doubling up helps struggling families make ends meet.

On the one hand, doubling up might bring more resources into a household, reducing hardship and making it easier to make ends meet. Conversely, doubling up might increase hardship if it stretches limited resources or increases household costs. Doubling up may also result in household crowding or a loss of privacy and can affect whether a household is eligible for public programs.

In our paper Household Composition and Family Well-Being: Exploring the Relationship Between Doubling Up and Hardship, we use data from the adult well-being topical modules of the 2008 Survey of Income and Program Participation to examine the relationship between doubling up and the different kinds of hardship, such as not having enough money to pay for common life expenses. We also look at whether changes in sharing a household were associated with changes in these hardships.

Consistent with prior research, we found that people living in doubled-up households were more disadvantaged and reported more hardship than those who did not double up. For example, people who doubled up were more likely to report that they had trouble making ends meet, paying their rent or mortgage, getting to the doctor and having enough to eat than those who did not double up.

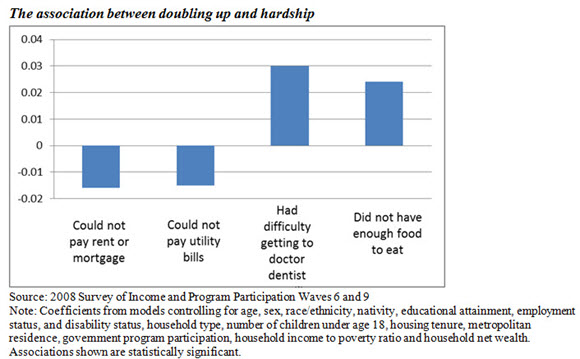

Moreover, we found the association between doubling up and hardship differs by type of hardship. Doubling up was associated with reduced housing and utility hardship. For example, these sharing households had less trouble paying housing and utility costs in models controlling for other individual and household characteristics (see figure below). The negative coefficients -0.01 and -0.02 illustrate the reduced likelihood of not being able to afford housing or utility costs while 0.03 and 0.025 represent the increased likelihood of not being able to get to the doctor when needed or not having enough food. This suggests that doubling up may be a strategy to alleviate hardship, such as insufficient income to pay for housing costs alone.

However, those who did double up were more likely to report difficulty getting to the doctor when needed and having enough food to eat. Although doubling up might reduce housing-related expenses, it may conversely reduce eligibility for public programs like the Supplemental Nutrition Assistance Program or force families to share limited food with more people, therefore increasing hardship.