A Tarnished Silver Lining: The Great Recession and Productivity

A Tarnished Silver Lining: The Great Recession and Productivity

Lucia Foster and Cheryl Grim – Center for Economic Studies, U.S. Census Bureau

John Haltiwanger – University of Maryland and U.S. Census Bureau

Recessions are costly in terms of high unemployment, lost output, and lost consumption. Still there is long running debate about whether recessions may have a silver lining, a long term “productivity-enhancing” effect.

This productivity-enhancing effect can occur through the movement or “reallocation” of resources (e.g., workers) across firms. In a well-functioning economy, resource reallocation typically directs resources from less productive firms to firms that are more productive. One strand of economic theory hypothesizes that the pace of this resource reallocation increases during recessions thus increasing productivity for the aggregate economy.

Alternatively, it is possible recessions will not be productivity enhancing due to market distortions. For example, even a high productivity firm might not be able to get credit needed to survive and grow if a recession distorts credit markets.

Previous research found evidence that recessions prior to the 2007-2009 “Great Recession” were productivity enhancing. However, the severity and persistence of the Great Recession and its close connection to the financial crisis suggest it may have been different. Did the Great Recession differ in its impact on the reallocation of resources across firms and the efficiency gains associated with such reallocation? To find out, we study recessions in the U.S. economy over the last 30 years.

The pace of job reallocation was low during the Great Recession

We start by looking at job reallocation, which is the sum of job creation and job destruction. The U.S. economy typically features a high pace of job reallocation across firms: the annual average job creation rate for the U.S. private sector over the last 30 years is close to 18 percent while the analogous job destruction rate is 16 percent. These combine to yield an overall annual average job reallocation rate of 34 percent.

Figure 1. U.S. Job Flows and the Business Cycle, 1981-2011 Source: Authorsâ calculations based on the Business Dynamics Statistics and the Current Population Survey. Notes: Cycle is the change in the unemployment rate. Changes are from March of year t-1 to March of year t. Shaded areas are NBER recessions.

Figure 1 shows job creation was as low during the Great Recession as during any period in the last 30 years. By 2011, job creation had still not fully recovered to pre-recession levels.

Further, job reallocation was also at a historical low during the Great Recession. When job destruction peaked in 2009, job reallocation was 28 percent, in contrast with a 35 percent reallocation rate in 1983. Lower than usual (for a recession) reallocation suggests the productivity-enhancing effect may have been weakened in the Great Recession.

Reallocation in the Great Recession was less productivity enhancing than in other recent recessions

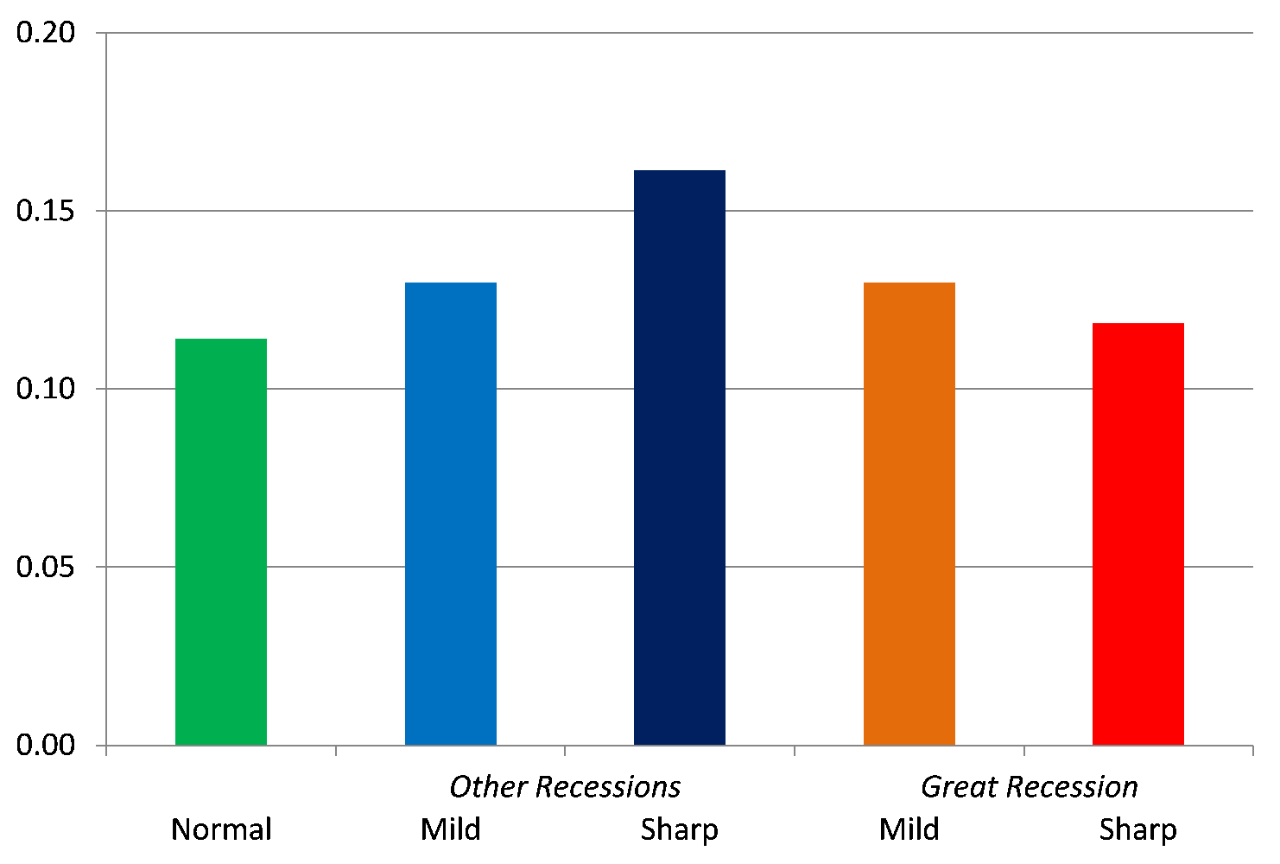

Figure 2. Differences in Employment Growth Rates Between High and Low Productivity Establishments Over the Business Cycle

Source: Authorsâ calculations based on the Annual Survey of Manufactures, Census of Manufactures and Longitudinal Business Database. Notes: The vertical bars in Figure 2 show the predicted difference in employment growth rates between high and low productivity establishments at five different points in the business cycle. A high [low] productivity establishment is one standard deviation above [below] industry-year mean productivity. Normal is zero change in state-level unemployment; mild contraction is a one percentage point increase in state-level unemployment; sharp contraction is a three percentage point increase in state-level unemployment; Great Recession is for the period 2007-2009.

The productivity-enhancing effect of recessions prior to the Great Recession is evident in the first three bars: the difference between growth rates increases with the severity of the recession. In contrast, the difference between growth rates decreases with severity during in the Great Recession (compare the last two bars).

In sum, we find the Great Recession is less productivity enhancing than earlier recessions because its reallocation is less intense and less efficient. The Great Recession was costlier than earlier recessions due to not only higher unemployment, more lost output, and more lost consumption, but also because there was less productivity-enhancing reallocation.

Our work here is about the “what” rather than the “why” of the Great Recession. In future work, we plan to examine why the Great Recession is less productivity enhancing than other recent recessions. One particular area of interest for future work is the role of the financial crisis in the Great Recession.

Want to know more? See our working paper “Reallocation in the Great Recession: Cleansing or Not?”