An official website of the United States government

Here’s how you know

Official websites use .gov

A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS

A lock (

) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

-

//

- Census.gov /

- Census Blogs /

- Research Matters /

- Falling House Prices and Labor Mobility

Falling House Prices and Labor Mobility

Falling House Prices and Labor Mobility

Has the recent housing bust, which left approximately a third of households with negative equity, “locked” workers into their current home and unable to move for new jobs? America has long been known as a place where people are willing to relocate for new opportunities. However, obstacles to labor mobility, such as house lock, may discourage workers from changing jobs and prevent the unemployed from finding a job, possibly prolonging the slow economic recovery.

Using a data source with a large sample size, such as the American Community Survey (ACS), can help get around this problem, but the ACS is a snapshot that doesn’t allow us to observe people moving during one time period to the next. However, by merging employment information from the Longitudinal Employer-Household Dynamics (LEHD) jobs database, I can determine if ACS respondents later begin a new job in a different city.

Using this matched dataset, I can observe many people located in a particular metropolitan area during the same time period. This enables me to compare homeowners to renters, and see how changes in their home price differentially affect their probabilities of relocating to another city for a new job in the LEHD data. Because these workers are all exposed to the same local economic conditions, if the mobility of owners appears to decline more compared to renters when the value of their home has fallen, then we can infer that the difference is due to the changes in the owners’ home equity.

To estimate whether a respondent has negative equity in their home, I used historical price information from a real estate company to see if the value of the individual’s house has declined since the date that they moved into it. Renters effectively serve as the control group in this setup because their migration behavior should not be directly impacted if the value of the house they are renting falls.

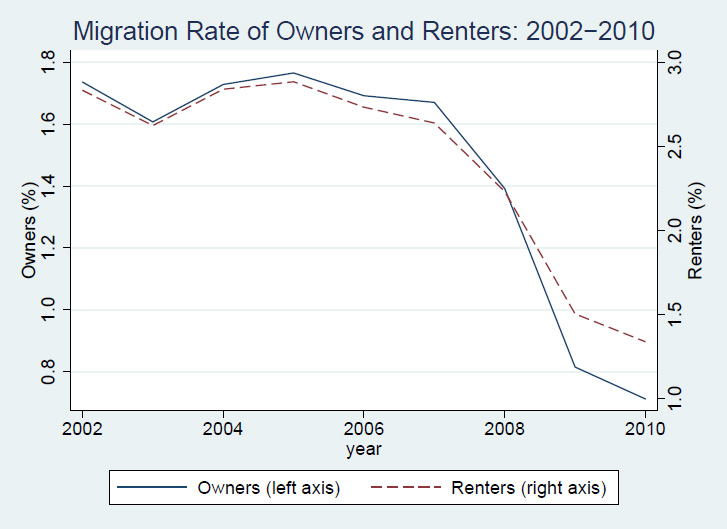

Results from statistical analyses using this strategy on data from 2002 to 2010 show that a homeowner with negative equity was about 20 percent less likely to move for a new job. The impact is similar if we look only at the unemployed. For context , the attached figure shows that the migration rate of homeowners fell by about 60 percent over the studied time period (from 1.7 percent per quarter to 0.7 percent ), while that of renters fell by less than half.

Note also that the migration rate fell for both owners and renters starting in 2005. During the depths of the housing crash in 2009-2010, the patterns for the two groups really began to diverge widely. This means that while migration fell in large part because of the general economic decline, the housing crash put additional downward pressure on the mobility of homeowners and could continue to do so until the market recovers.

Share

Yes

Yes

No

NoComments or suggestions?

Top