What Is the Supplemental Poverty Measure and How Does It Differ From the Official Measure?

What Is the Supplemental Poverty Measure and How Does It Differ From the Official Measure?

Since the publication of the first official U.S. poverty statistics, there has been a continuing debate about the best way to measure income and poverty in the United States.

In 2010, an interagency technical working group asked the U.S. Census Bureau and the U.S. Bureau of Labor Statistics to develop a new measure that would improve our understanding of the economic well-being of American families and enhance our ability to measure the effect of federal policies on those living in poverty. The technical design of the supplemental poverty measure draws on the recommendations of a 1995 National Academy of Sciences report and the extensive research on poverty measurement conducted over the past 20 years. See the history of poverty measures in the United States infographic.

President Johnson’s 1964 declaration of his “War on Poverty” generated a new interest in measuring just how many people were in poverty and how that changed over time.

Next week, the Census Bureau will release the latest report on the supplemental poverty measure. The report presents estimates for the official and supplemental poverty measures and discusses differences between the two measures. A comparison of the major concepts is detailed in the table below and in this infographic.

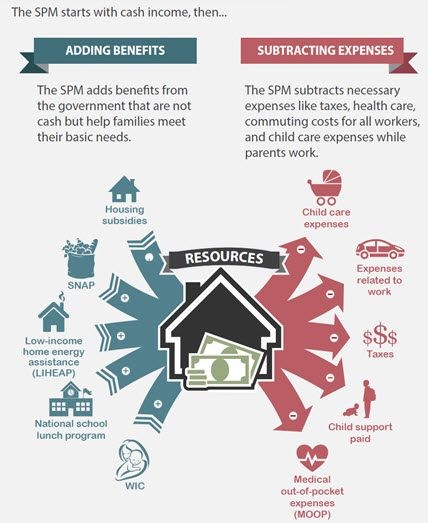

We measure poverty two ways every year. The official poverty measure is based on cash resources. The supplemental poverty measure uses cash resources and also includes noncash benefits and subtracts necessary expenses (such as taxes and medical expenses).

Poverty Measure Concepts: Official and Supplemental |

||

Official Poverty Measure |

Supplemental Poverty Measure |

|

Measurement Units |

Families (individuals related by birth, marriage or adoption) or unrelated individuals |

Resource units (official family definition plus any co-resident unrelated children, foster children, and unmarried partners and their relatives) or unrelated individuals (who are not otherwise included in the family definition) |

Poverty Threshold |

Three times the cost of a minimum food diet in 1963 |

Based on expenditures of food, clothing, shelter and utilities—FCSU |

Threshold Adjustments |

Vary by family size, composition and age of householder |

Vary by family size and composition, as well as geographic adjustments for differences in housing costs by tenure |

Updating Thresholds |

Consumer Price Index: all items |

Five-year moving average of expenditures on FCSU |

Resource Measure |

Gross before-tax cash income |

Sum of cash income, plus noncash benefits that resource units can use to meet their FCSU needs, minus taxes (or plus tax credits), minus work expenses, medical expenses, and child support paid to another household |

The official poverty measure compares an individual’s or family’s pretax cash income to a set of thresholds that vary by the size of the family and the ages of the family members. These official poverty calculations do not take into account the value of in-kind benefits, such as those provided by nutrition assistance or housing and energy programs. Nor do they take into account regional differences in living costs or expenses, such as housing.

The supplemental poverty measure takes into account family resources and expenses not included in the official measure as well as geographic variation. First, it adds the value of in-kind benefits that are available to buy basic goods to cash income. In-kind benefits include nutritional assistance, subsidized housing and home energy assistance. Then it subtracts necessary expenses for critical goods and services not included in the thresholds from resources. Necessary expenses that are subtracted include income taxes, Social Security payroll taxes, child care and other work-related expenses, child support payments to another household, and contributions toward the cost of medical care and health insurance premiums.

Thresholds used in the supplemental poverty measure are produced by the Bureau of Labor Statistics Division of Price and Index Number Research using Consumer Expenditure Survey data that show how much people spend on basic necessities (food, clothing, shelter and utilities) and are adjusted for geographic differences in the cost of housing. The supplemental poverty measure thresholds are not intended to assess eligibility for government assistance.

Next week’s report will compare supplemental poverty estimates with official poverty estimates for numerous demographic groups. It will also provide state-level supplemental poverty statistics using three years of Current Population Survey Annual Social and Economic Supplement data and compare last year’s supplemental poverty estimates with the latest estimates. In addition, the report will examine the effect on supplemental poverty rates of excluding specific resource or expenditure elements, such as noncash benefits, tax credits and medical expenses.

For more details on the supplemental poverty measure, please see the technical appendixes of the September 2017 report or the technical webinar presented in November 2011.