Census Bureau Releases 2015 Supplemental Poverty Measure

Census Bureau Releases 2015 Supplemental Poverty Measure

Today the U.S. Census Bureau, in collaboration with the Bureau of Labor Statistics, released its sixth annual supplemental poverty measure report. This measure extends information provided by the official poverty measure by explicitly including benefits from many of the government programs designed to assist low-income families and individuals.

According to the report, the supplemental poverty measure (SPM) rate in 2015 was 14.3 percent, which was significantly lower than the rate of 15.3 percent in 2014. The supplemental rate was higher than the official poverty rate of 13.5 percent in 2015.

Since the publication of the first official U.S. poverty estimates in 1964, there has been a continuing discussion about the best approach to measure income and poverty in the United States. In 2009, an interagency group asked the Census Bureau, in cooperation with the Bureau of Labor Statistics, to develop a supplemental measure to allow for an improved understanding of the economic well-being of American families and the impact of federal policies.

The supplemental poverty measure differs from the official measure in several key ways. First, the official measure only looks at pretax money income, while the supplemental measure adds the value of noncash benefits, such as the Supplemental Nutrition Assistance Program, school lunches, housing assistance and refundable tax credits like the Earned Income Tax Credit into the definition of “income” or “resources.” Additionally, necessary expenses for essential goods and services such as taxes, childcare and work expenses, and contributions toward the cost of medical care and health insurance premiums are deducted from income in the supplemental measure.

The supplemental measure also uses a more inclusive definition of family (including unmarried partners and their relatives, unrelated children and foster children). Finally, the supplemental measure applies geographically-adjusted thresholds that adjust for family composition and housing tenure status.

One important contribution of the supplemental poverty measure is that it allows one to gauge the effectiveness of tax credits and transfers in reducing poverty. It can also show the impact of necessary expenses, such as paying taxes or work-related and medical out-of-pocket expenses, on a family’s ability to meet basic needs.

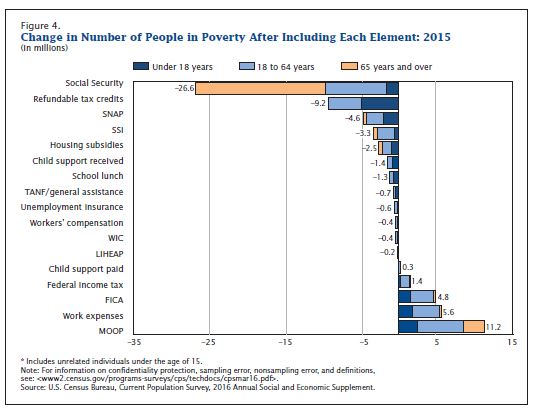

For example, the SPM report shows that:

- Without Social Security benefits, the supplemental poverty rate overall would have been 8.3 percentage points higher. This represents about 26.6 million more individuals in poverty, including 17.1 million individuals age 65 and older.

- People 65 and older had a supplemental poverty rate of 13.7 percent, equating to 6.5 million people in poverty. Excluding Social Security from income would more than triple the poverty rate for this group, resulting in a poverty rate of 49.7 percent.

- Not including refundable tax credits (the Earned Income Tax Credit and the refundable portion of the child tax credit) in resources would have resulted in an additional 9.2 million individuals falling into poverty, a 2.9 percentage point increase.

- Not accounting for refundable tax credits for children would have resulted in a poverty rate of 22.6 percent rather than 16.1 percent. This difference represents 4.8 million children who would have been considered poor in the absence of these credits.

- Taking account of other noncash benefits also lowered poverty rates. For example, Supplemental Nutrition Assistance Program benefits lowered the overall poverty rate by 1.4 percentage points or 4.6 million people.

The figure below shows the effect of various elements of the supplemental poverty measure on the number of individuals below poverty for 2015. Each bar is divided by the age composition of the population affected by the inclusion of each element.

Social Security transfers and refundable tax credits had the largest impacts in raising individuals above the SPM poverty thresholds, with Social Security affecting the largest number of adults ages 18 to 64 and 65 years and older, while refundable tax credits affected the largest number of children.

For more information, check out The Supplemental Poverty Measure: 2015 report.