What is the Supplemental Poverty Measure and How Does it Differ from the Official Measure?

What is the Supplemental Poverty Measure and How Does it Differ from the Official Measure?

In September, the U.S. Census Bureau released official poverty statistics for the United States for the 2013 calendar year. The current official poverty measure was developed in the early 1960s, and only a few minor changes have been implemented since that time.

In 2010, an interagency technical working group asked the Census Bureau and the Bureau of Labor Statistics to develop a new measure that would improve our understanding of the economic well-being of American families and enhance our ability to measure the effect of federal policies on those living in poverty. The technical design of the supplemental poverty measure draws on the recommendations of a 1995 National Academy of Sciences report and the extensive research on poverty measurement conducted over the past 15 years. See the history of poverty measures in the United States here:

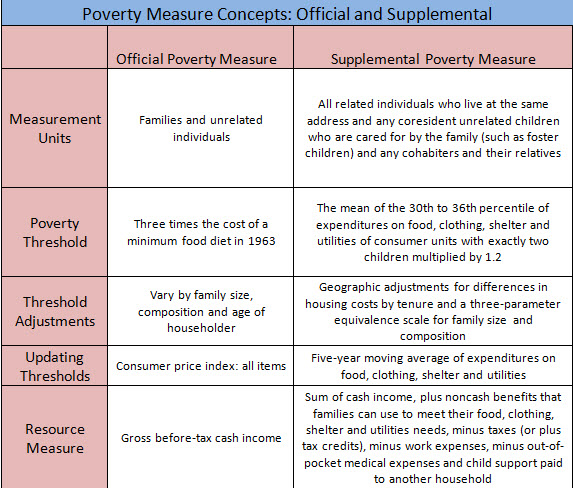

This week, the Census Bureau will release the fourth report on the supplemental poverty measure, containing estimates for the 2013 calendar year. The report presents estimates for and discusses differences between the official and the supplemental poverty measures. The major differences are listed in the box below and in this chart:

The official measure compares a family’s or individual’s before-tax cash income to a set of thresholds based on the cost of a minimum food diet in 1963, updated to 2013 by changes in prices. To determine poverty status, the measure compares the family’s cash income, such as earnings from a job or Social Security benefits, with the official poverty threshold. It does not take account of the value of important federal programs, such as the Supplemental Nutrition Assistance Program, and housing and energy assistance, nor does it account for refundable tax credits, such as the Earned Income Tax Credit, aimed specifically at families with low income.

The supplemental poverty measure does take into account family resources and expenses not included in the official measure. The value of noncash benefits that are available to buy the basic bundle of goods are added to cash income. Necessary expenses for critical goods and services are subtracted, such as income taxes, social security payroll taxes, child care and other work-related expenses, out-of-pocket contributions toward the cost of medical care and health insurance premiums, and child support payments to another household.

Thresholds used in the new measure are prepared at the Bureau of Labor Statistics and derived from the Consumer Expenditure Survey. They are based on the most recent five-year reports on how much people spend on basic necessities (food, shelter, clothing and utilities) and are adjusted for geographic differences in the cost of housing.

This week’s report will compare 2013 supplemental poverty estimates with 2013 official poverty estimates for numerous demographic groups. It will provide state-level poverty estimates and show how our perception of the poverty population differs from that using the official statistics. In addition, the report will examine the effect of noncash benefits, tax credits and necessary expenses on supplemental poverty rates.

For more details on the new measure, please see the technical appendices of the November 2013 report or the technical webinar presented with the release of the first supplemental poverty measure report in November 2011.