The Funding of our State and Local Governments

The Funding of our State and Local Governments

These days the health of our state and local governments is a topic that is much debated. Are our state and local governments solvent? Will they continue to be able to provide the services we expect and depend on? Will our state and local governments be the next housing crisis? Or is the reality somewhere in between?

The U.S. Census Bureau’s 2009 Annual Surveys of State and Local Government Finances provide a look at the revenues, assets, expenditures, and debt of our nation’s governments. These data help us better understand the fiscal health of our governments and allow us to begin to answer the questions above.

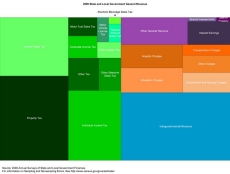

In order to understand the health of our governments, we must first understand how they are funded – or where the revenue comes from. Once that foundation is built, we can then understand how they spend our money. (See figure: Revenue of State and Local Governments: 2009).

State and local government revenues declined 22.1 percent from 2008 to receipts of $2.1 trillion in 2009. The general revenue funds of state and local governments totaled $2.4 trillion in 2009. As shown in the figure above, the major components of general revenue for state and local governments in 2009 were taxes (52.7 percent), federal support (22.2 percent) and charges (16.1 percent).

Taxes are the principal source of general revenue for our governments comprising 47.8 percent of general revenue for state governments and 39.5 percent of general revenue for local governments in 2009. Overall, tax revenue declined by 4.5 percent for all governments to

$1.3 trillion in 2009. This decline was driven by declines in receipt of monies from individual income and corporate taxes (11.3 and 19.2 percent, respectively).

State and local governments differ in their dependence on federal funding for their support. In 2009, state governments received 31.8 percent of their general revenue from the federal government; whereas, local governments received 4.3 percent of their general revenue directly as federal support. [Note, local governments receive a considerable amount of funding as “pass-through” funding from their state government. This funding originated at the federal level but because it “passes through” the state it is accounted for as state revenue in our data.]

The rest of the funding of our state and local governments comes from a variety of sources (as shown above), including current charges, utility revenue, liquor store revenue and insurance trust revenue. Typically, at the state level, insurance trust revenue (or revenue from investments related to state government pension and other trust funds) is the next largest generator of funds. However, this was not the case in 2009. In 2009, current charges was the next largest generator of funds at $161.2 billion. Insurance trust revenue declined in 2009. For both state and local governments, current charges generated $388.8 billion in 2009.

That is the picture of how our state and local governments generate the monies they need to provide us with services. Coming soon, “Your Tax Dollars at Work: How our State and Local Governments Spend our Money.”

These statistics are available for all state and local governments. To understand your governments’ finances for 2009, visit our website.