How to Choose the Correct Port of Export

How to Choose the Correct Port of Export

Have you tried to file Electronic Export Information (EEI) in the Automated Export System (AES) but the information is rejected by the system based on the port of export? What would be the correct port of export you should report? This is one of the most frequently asked questions from the trade community.

Let us suppose, for example that you are creating an export filing for an air shipment that will depart from San Francisco, Calif. You have entered port of export code 2809 for San Francisco. However, the AES generated a fatal error message with response code 133: Port of Export Must Be An Air Port. How do you choose the correct port of export? First, let us take a look at how a port of export is defined.

What is the port of export?

Per the Foreign Trade Regulations (FTR) 30.1(c), the port of export is the U.S. Customs and Border Protection (CBP) seaport or airport where the goods are loaded on the aircraft or vessel that is taking the goods out of the United States, or the CBP port where exports by overland transportation cross the U.S. border into Canada or Mexico.

Resources to help you choose the correct port of export.

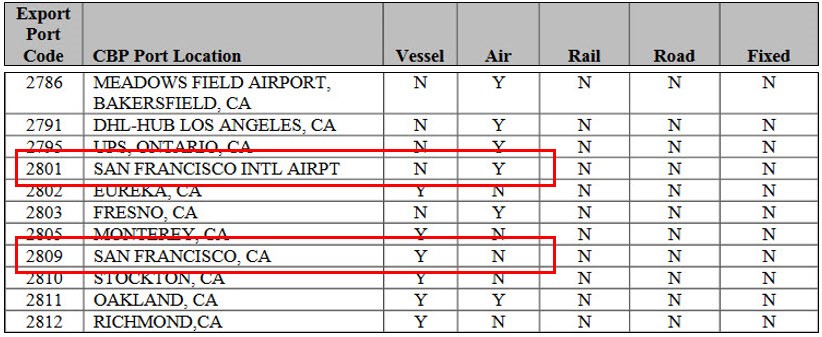

First, verify the port of export code that you are reporting in the AES is valid for the mode of transportation of your shipment. Appendix D of the Automated Export System Trade Interface Requirements (AESTIR) on the CBP’s website is an important resource, and it provides a full list of export port codes as well as valid modes of transportation for each port.

When looking at Appendix D, you will notice that port of export code 2809 for San Francisco is not valid for air shipments. However, port of export code 2801 for San Francisco International Airport is valid:

It is considered best practice to contact the carrier of your shipment and verify the port of export information.

Please note, if you receive a fatal error after reporting an invalid port of export code, you must correct and retransmit your export filing using the correct port of export code to receive a valid Internal Transaction Number (ITN) prior to exporting your shipment. Your goods cannot be exported without an ITN.

For guidelines on how to resolve AES fatal errors, you may refer to Appendix A of the AESTIR and locate the three-digit response code as well as resolution guidance. If you have further questions, please contact the Data Collection Branch at 800-549-0595 using option 1 or via email to <[email protected]>.