An official website of the United States government

Here’s how you know

Official websites use .gov

A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS

A lock (

) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

-

//

- Census.gov /

- Newsroom /

- Census Blogs /

- Global Reach /

- Exporting With Import Classification Numbers

Exporting With Import Classification Numbers

Exporting With Import Classification Numbers

If you focus on U.S. trade compliance, you learn Schedule B numbers are U.S. export classification codes and Harmonized Tariff Schedule (HTS) numbers are U.S. import classification codes. Yet, as you may have discovered, HTS codes can also be used for exporting in most cases. In this blog, we are going to dive into the details of why this is true.

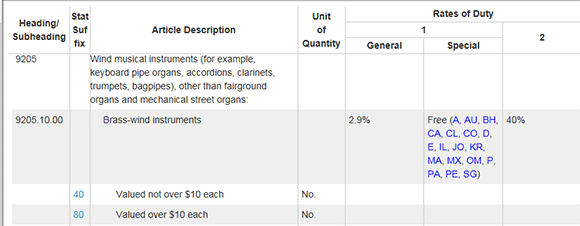

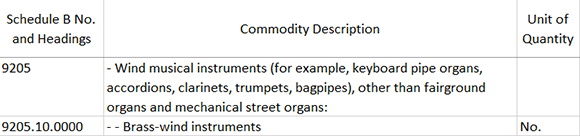

The first six digits of an HTS and Schedule B number will always be the same for a particular product. A key difference between the HTS and Schedule B 10-digit classification systems is the number of codes. There are approximately 19,000 HTS codes, compared to about 9,000 Schedule B codes. The additional detail for HTS classifications means multiple HTS numbers can correlate to a single Schedule B number. After you file your export shipment with an HTS number, we convert the HTS number to a Schedule B number for statistical purposes. Allowing dual use of HTS codes can save filers time in completing required forms.

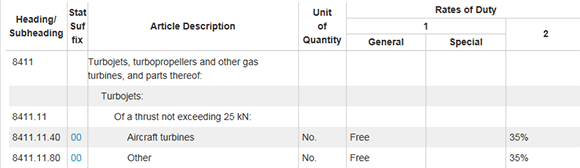

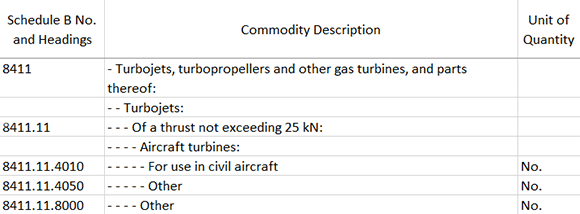

We cannot accept the aircraft turbine HTS number for an export shipment because the code does not provide the specific detail required by the Schedule B.

To know which HTS numbers cannot be used for export, see HTS codes that are not valid for Automated Export System on the Census Bureau’s Foreign Trade website.

Alternatively, the Notice to Exporters found in the Harmonized Tariff Schedule at the U.S. International Trade Commission website lists the Schedule B numbers needed for export in place of HTS numbers.

For more information about Schedule B classification, visit census.gov/scheduleb or contact the Micro Analysis Branch at 800-549-0595, option 2.

Share

Yes

Yes

No

NoComments or suggestions?

Top