An official website of the United States government

Here’s how you know

Official websites use .gov

A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS

A lock (

) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

-

//

- Census.gov /

- Census Blogs /

- Global Reach /

- Determining Value & License Value

Determining Value & License Value

Determining Value & License Value

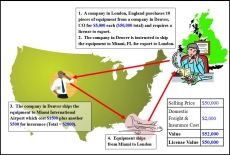

Are you in the business of exporting licensed shipments? It sure can be tricky! If you haven’t heard already, requirements for filing licensed goods in the Automated Export System (AES) recently changed. In addition to reporting the value, you are required to report license value in the AES. Let’s take a look at how to determine value and license value to ensure you avoid costly mistakes.

If you have questions regarding value or license value, please contact the Trade Regulations Branch at (800)-549-0595, Option 3 or e-mail ftdregs@census.gov.

Share

Yes

Yes

No

NoComments or suggestions?

Top