How to Report Discounts in the Automated Export System

How to Report Discounts in the Automated Export System

Whether you are a buyer or a seller, who doesn’t love a great deal?

Despite their benefit, not all discounts are considered equal when it comes to reporting the value in the AES. The Foreign Trade Regulations (FTR) §30.6(a)(17) define value as the net selling price plus the inland or domestic freight cost, insurance and any other charges incurred to get the shipment to the U.S. port of export.

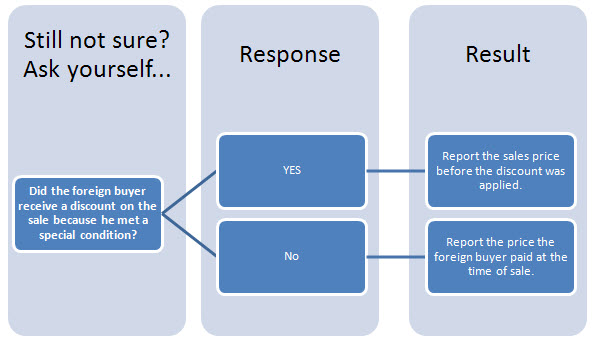

The value should reflect the net selling price the foreign buyer has paid the USPPI for the goods. However, if a foreign buyer receives a discount on the export sale, the discount may or may not need to be deducted from the selling price. According to the FTR, if the foreign buyer received a discount based on a condition he or she performed or acted, then it should not be deducted from the net selling price. Let’s take a look at the scenarios below:

Scenario 1: Include Discount in Value

Let us say you are in the business of selling and exporting vehicles and decide to have a sale on all your older model cars. Your sale then leads a man in Puerto Rico to purchase a vehicle. In this case, the discounted sales price along with all the other cost detailed in FTR §30.6(a)(17)(i) would be incorporated in the value reported in the AES. This discounted sales price would be the reported net selling price because it is an unconditional discount; the discounted sales price applies to everyone who purchases a car from the seller.

Scenario 2: Exclude Discount from Value

However, let us say the seller says to the foreign buyer, “If you pay cash you will receive an additional 10% discount.” The foreign buyer agrees and pays cash. In this case, the sales price before the additional 10% discount would be the selling price to be reported in the AES {see FTR §30.6(a)(17)(i) }. The selling price would not include the 10% discount from the sales price because it is conditioned on the customer paying cash.

The Bottom Line

For more information please reference Section 30.6 (17)(i) of the Foreign Trade Regulations( FTR).