COVID-19 Adds to Economic Hardship of Those Most Likely to Have Student Loans

Ballooning student debt was already a concern prior to COVID-19 but the widespread economic hardship brought on by the pandemic, including a spike in unemployment, has left some groups in even more precarious financial conditions than before.

Student loans are among the largest contributors to household debt. The U.S. Department of Education estimates that in 2017 the total amount owed in federal student loans was $1.37 trillion.

Younger adults, particularly those in their late 20s and early 30s, held a disproportionate amount of debt and clear racial and ethnic differences existed in this age group as well.

Experiences prior to and during the pandemic provide insight into what we can expect going forward.

In 2017, 15% of adults (33 million) who had completed at least a high school degree had student loan debt, according to the Census Bureau’s Survey of Income and Program Participation (SIPP), which provides detailed info about debt holders in the years preceding the pandemic (all subsequent SIPP estimates are limited to those with at least a high school degree).

But the number was higher for certain groups: 21% of non-Hispanic Black adults; 23% of never-married adults; and 29% of adults ages 25 to 34.

Education and Debt Go Hand in Hand

Student debt was tied to educational attainment or the highest degree someone has received.

About 1 in 4 adults with advanced degrees, meaning those with more than a bachelor’s degree, had at least some student debt, compared to fewer than 1 in 5 adults with an associate or two-year degree.

Those with only a high school diploma were the least likely to carry student debt. But even this group accrued debt if they started but did not complete college courses or took vocational training, such as trade certifications or licensing.

Although those with advanced degrees were the most likely to hold and have higher student debt, those with some college but no degree were in a particularly difficult double bind: They accumulated debt during college but were yet to benefit from the greater earnings that come with a college degree.

In 2017, median annual earnings of those with some college but no degree was significantly less than among those with a bachelor’s or higher degree, making it more challenging for them to pay off their student debt. And while some may eventually complete a college degree, many will not.

Who is Most Likely to Have Student Loans?

Racial differences in student debt holding are stark.

Non-Hispanic Black adults were particularly likely to have student debt.

In 2017, for example, rates for some non-Hispanic Black groups were twice as large as for non-Hispanic White adults and Black adults were more likely than White adults at every educational attainment level to have student loans.

Women overall were 28% more likely than men to have student debt.

In 2017, non-Hispanic Black women were the most likely of any gender group to have student loans. About 1 in 4 non-Hispanic Black women had student debt, compared to 1 in 8 non-Hispanic White men.

Younger adults, particularly those in their late 20s and early 30s, held a disproportionate amount of debt and clear racial and ethnic differences existed in this age group as well.

Among adults ages 25 to 44, Hispanic adults were the least likely to have student debt, partly a reflection of the lower likelihood of college attendance among the Hispanic population.

Roughly a third of non-Hispanic Black and White adults ages 25 to 34 held student debt.

However, older Black adults were significantly more likely than White adults to still have debt.

Differences by educational attainment and race were so large that non-Hispanic Black adults who had attended college but not earned a degree were about as likely as non-Hispanic White adults who had completed advanced degrees (21% and 22%, respectively) to carry student debt.

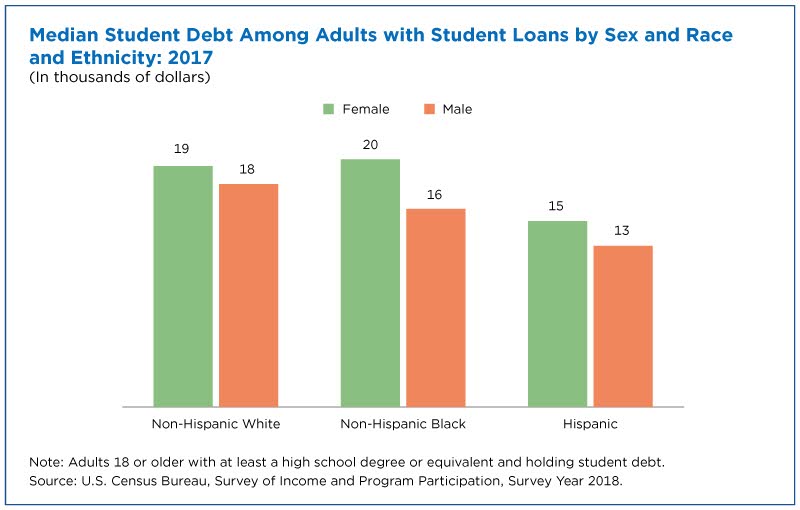

Median student debt in December 2017 was similar for non-Hispanic Black women and non-Hispanic White women, with each group each carrying roughly $20,000.

Non-Hispanic White women, who made up the largest percentage of college graduates, carried as a group an estimated $398 billion in student loans in 2017.

Non-Hispanic White men, the second-largest student debt group, owed $278 billion in student loans. Non-Hispanic Black women carried $110 billion and Hispanic women an estimated $54 billion in student debt.

According to SIPP, adults with at least a bachelor’s degree had student debt totaling $756 billion.

Student Loan Debt Associated With More Debt Overall

Many adults with student loans also faced other debt burdens. Of those with student loans, about 23 million (69%) had at least one additional type of debt like credit card, vehicle or medical.

Among those with student loans, credit card debt was the most common additional debt (52% of those with student debt also had credit card debt), followed by vehicle loans (33%), and medical debt (18%).

Those with debt on top of their student loans also often owed more in student loans.

For instance, the median student debt of those with no credit card debt was $16,000 in 2017. However, those with both student and credit card debt owed a median amount of $20,000 in student loans.

COVID-19 Adds Layers of Economic Hardship

Since 2017, federal student loans have increased an additional $190 billion, totaling $1.57 trillion in 2020. The onset of the COVID-19 pandemic has piled on additional layers of economic challenges on top of existing loan burdens.

Responses to the Census Bureau’s experimental Household Pulse Survey highlight how some groups for whom student debt may present particular challenges have also been hardest hit by the pandemic.

For example, those with some college but no degree were more likely to have experienced a loss of employment income within their household since the start of the pandemic. They were also more likely to report having a somewhat or very difficult time paying their usual expenses in the prior week than those with at least a bachelor’s degree.

In an effort to reduce the burden of student debt during the pandemic, the government has frozen payments for federal student loans and interest rates have been set to zero.

However, these policies are only temporary. Even with high national unemployment and without a current need to pay down this debt, recent stimulus money has been used to reduce debt burden.

Although the stimulus payments received in January were not more than $600 per person, more than three quarters of the people who received them spent them immediately and about half reported spending it to pay down credit card, student loan or other debt.

The populations most likely to carry student debt were even more likely to use the January stimulus payment to pay down debt.

For example, women were more likely than men to use the stimulus to narrow debt. Similarly, more than 60% of both non-Hispanic Black respondents and Hispanic respondents also used that money to shrink debt compared to less than 50% of non-Hispanic White respondents.

These results suggest that despite the freeze on payments student loan debt is still a heavy burden for many households during the pandemic.

About the Data

SIPP is the nation’s premier source of information for income and program participation. It collects data and measures change in Americans’ economic well-being, family dynamics, education, assets, health insurance, child care and food security. Information on the methodology and reliability of these estimates can be found in the source and accuracy statements for each SIPP data release.

HPS is designed to provide near real-time data on how people’s lives have been impacted by the coronavirus pandemic. Information on the methodology and reliability of these estimates can be found in the source and accuracy statements for each HPS data release.

Michael D. King and Lindsay M. Monte are survey statisticians in the Census Bureau’s Program Participation and Income Transfers Branch.

Neil Bennett is an economist in the Census Bureau’s Labor Force Statistics Branch.

Subscribe

Our email newsletter is sent out on the day we publish a story. Get an alert directly in your inbox to read, share and blog about our newest stories.

Contact our Public Information Office for media inquiries or interviews.

-

America Counts StoryWhat's the Financial Condition of Homes Getting Government Benefits?May 25, 2021The Survey of Income Program Participation shows that many families that received government aid in 2017 lacked assets but had similar levels of unsecured debt.

-

America Counts StoryDespite Unemployment Insurance, Many Households Struggle With BasicsMarch 09, 2021The Household Pulse Survey shows that 31.2% of households that used unemployment insurance reported a very difficult time paying for usual household expenses.

-

America Counts StoryDoes Majoring in STEM Lead to a STEM Job After Graduation?June 02, 2021Among STEM workers, those who majored in STEM earned more than those who did not.

-

IncomeHow Income Varies by Race and GeographyJanuary 29, 2026Median income of non-Hispanic White households declined in five states over the past 15 years: Alaska, Connecticut, Louisiana, Nevada, and New Mexico.

-

HousingRental Costs Up, Mortgages Stayed FlatJanuary 29, 2026Newly Released American Community Survey compares 2020-2024 and 2015-2019 housing costs by county.

-

HousingShare of Owner-Occupied, Mortgage-Free Homes Up in 2024January 29, 2026The share of U.S. homeowners without a mortgage was higher in 2024 than a decade earlier nationwide and in every state, though not all counties saw increases.

-

PopulationU.S. Population Growth Slowest Since COVID-19 PandemicJanuary 27, 2026The decline in international migration was felt across the states, though its impact varied.