For Renters, Housing Cost Burden Is About the Same

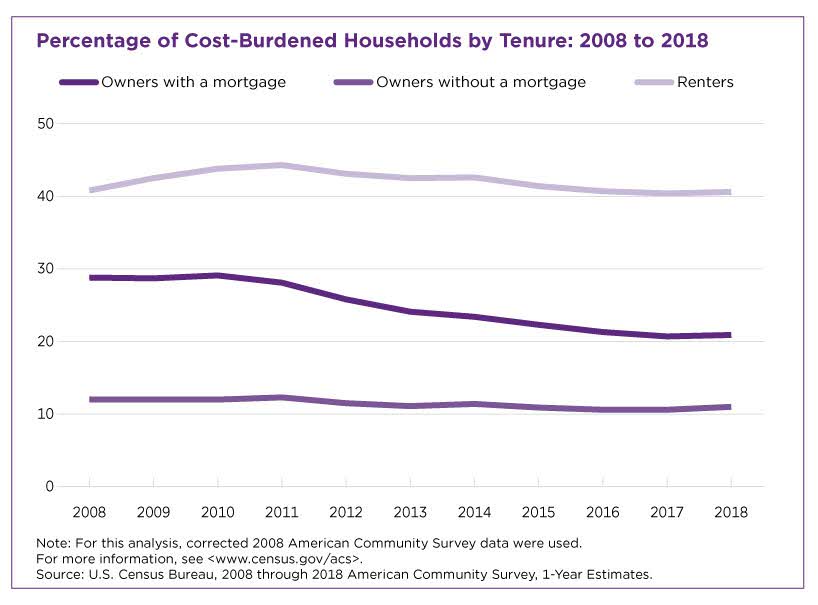

The housing cost burden has eased for U.S. homeowners but remained stagnant for renters since the peak of the recession in 2008.

Recently released data from the American Community Survey (ACS) estimates the percentage of “burdened” households, or those that spend at least 35% of their monthly income on housing costs, and provides a 10-year look at the trends from 2008 to 2018.

An estimated 40.6% of rental unit residents spent 35% or more of their monthly household income on rent and utility bills last year.

Burden Depends on Mortgage Status

There were 77.7 million owner-occupied housing units in the United States in 2018. Approximately 62% of these homeowners had a mortgage, down 6.5 percentage points from 2008.

For the purposes of this analysis, a burdened owner-occupied household is one where the homeowner spends 35% or more of their monthly household income on mortgage payments, utility bills, real estate taxes, property insurance, and any required condominium or mobile home fees.

In 2018, 20.9% of homeowners with a mortgage were burdened. That’s down about eight percentage points from 10 years prior when 28.8% of homeowners with a mortgage were burdened.

Housing costs also eased slightly for homeowners without a mortgage or who own their homes free and clear.

According to the ACS, even without a mortgage payment, 11.0% of these households were burdened in 2018, compared with 12.0% in 2008.

Renters Still Burdened

The picture wasn’t quite as bright for the nation’s 43.8 million renters. An estimated 40.6% of rental unit residents spent 35% or more of their monthly household income on rent and utility bills last year. That’s a dip of only 0.2 percentage points from 2008 when 40.8% of renters were burdened.

Housing Burden in Metro Areas

Changes at the metro area level followed a similar trend as the nation.

Some highlights:

- In 2008, there were 43 metro areas where at least 40% of homeowners with a mortgage were burdened. There were none in 2018.

- In 2018, 53 metro areas reported that over 10% of homeowners without a mortgage were burdened, compared with 85 metro areas in 2008.

- The number of metro areas where more than 40% of renters were burdened in 2018 was 81, the same amount as a decade earlier.

The ACS is an ongoing survey that publishes annual estimates on a range of housing, demographic, social, and economic characteristics. ACS estimates from 2008 were based on data corrected after they were originally released. For more information, see the U.S. Census Bureau’s note.

Related Statistics

Subscribe

Our email newsletter is sent out on the day we publish a story. Get an alert directly in your inbox to read, share and blog about our newest stories.

Contact our Public Information Office for media inquiries or interviews.

-

HousingThe Impact of the Tech Boom on HousingApril 30, 2019Zillow economists combine Census Bureau housing data and their statistics to measure the impact of the tech boom on rental prices and home values.

-

PopulationHow Census Bureau Data Can Help Older Americans Afford HousingNovember 27, 2018King County, Wash., increased enrollment in a housing affordability program for older Americans using the American Community Survey.

-

HousingNIMBY Meets YIMBY: Housing Movement Pushes for More HousingMay 22, 2018Skyrocketing housing prices fuel the Yes In My Backyard campaign popular in costly metropolitan areas such as San Francisco.

-

IncomeHow Income Varies by Race and GeographyJanuary 29, 2026Median income of non-Hispanic White households declined in five states over the past 15 years: Alaska, Connecticut, Louisiana, Nevada, and New Mexico.

-

HousingRental Costs Up, Mortgages Stayed FlatJanuary 29, 2026Newly Released American Community Survey compares 2020-2024 and 2015-2019 housing costs by county.

-

HousingShare of Owner-Occupied, Mortgage-Free Homes Up in 2024January 29, 2026The share of U.S. homeowners without a mortgage was higher in 2024 than a decade earlier nationwide and in every state, though not all counties saw increases.

-

PopulationU.S. Population Growth Slowest Since COVID-19 PandemicJanuary 27, 2026The decline in international migration was felt across the states, though its impact varied.